BoAt to File DRHP for ₹2,000 Cr IPO — Big Listing Buzz You Can’t Miss

Aug 15, 2025

BoAt, a leading Indian consumer electronics well-confined brand, is making waves within the financial market with its expected Initial Public Offering (IPO). The company is still in the process to file its Draft Red Herring Prospectus (DRHP) for a substantial ₹2,000 crore IPO. Following this making efforts and documenting RHP for a clear path. This move has generated considerable listing buzz amongst investors and marketplace experts enthusiasts, signalling a pivotal moment for the brand and the wider electronics sector. The BoAt IPO is expected to be a landmark event, attracting massive attention from early investors.

Imagine Marketing, the parent corporation of the prominent consumer electronics brand boAt, has confidentially filed its Draft Red Herring Prospectus (DRHP) with SEBI for a ₹2,000 crore Initial Public Offering (IPO). This marks the company's 2nd attempt to make a mark in public, following a withdrawn IPO plan in January 2022 due to detrimental market conditions. The cutting-edge filing through the confidential pre-filing path lets the enterprise maintain privacy concerning the IPO information, together with the boAt IPO price and particular issue structure, till later phrases, presenting flexibility in finalising the offer. This strategic approach pursuits to avoid investor fatigue, frequently associated with prolonged waiting periods between DRHP filing and IPO release.

Confidential Filing Route

SEBI introduced the pre-filing of offer documents as an non-compulsory alternative mechanism for Main Board IPOs in November 2022. This exclusive path allows groups greater flexibility in timing their public offering presentation, as it provides an 18-month window to proceed with the IPO after receiving the very last and final remarks from the regulator, as compared to the normal 12 months for traditional filings.

This prolonged timeline permits corporations like boAt to align their public IPO launch with beneficial market conditions without instantaneous public pressure or scrutiny. The process includes preliminary and private assessment by SEBI, observed by public disclosure of an Updated Draft Red Herring Prospectus (UDRHP-I) after incorporating regulatory observations. Boat shares in the unlisted market are currently trading around ₹1,535 per equity share, reflecting strong investor interest ahead of its planned IPO.

About the company

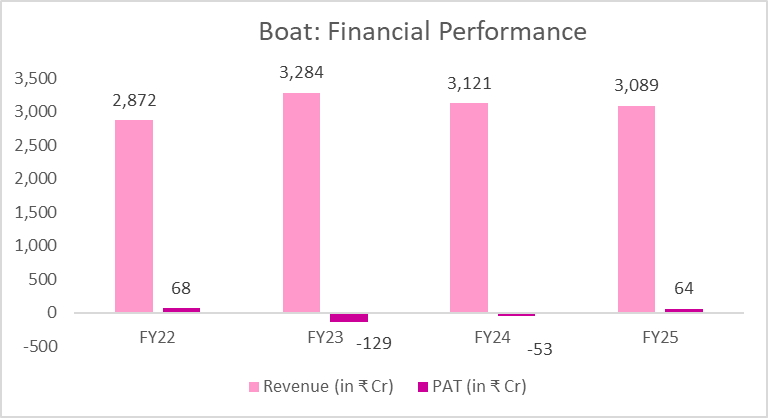

Boat, founded in 2013 by Aman Gupta and Sameer Mehta, has grown into one of India's largest digital-first manufactures and brands, holding main market positions in more than one fast-developing product categories, which include audio devices, smart wearables, and cell accessories. The brand is recognised for presenting splendid offerings, aspirational lifestyle-centered merchandise at accessible price factors. In FY24, the company recorded revenue of ₹3,121 crore, and reduced its loss by almost half having ~53. The corporation has additionally made enormous investments in local manufacturing and production, with about 70-75% of its audio and wearable products now produced domestically through partnerships like Dixon Technologies, assisting the 'Make in India' initiative and improving supply chain performance.

Boat: IPO Details

The boAt IPO is predicted to be a mixture and combination of fresh issuance of equity shares and an offer-for-sale (OFS). In its previous attempt, the ₹2,000 crore IPO was to comprise a fresh issue of ₹900 crore and an OFS of as much as ₹1,100 crore. While the exact breakdown for the present offering is still yet to be disclosed, the capital raised from this IPO is intended to fuel boAt's increased growth via increasing into new categories like smart rings and AI-based entirely health technology, enhancing brand visibility, scaling in-house manufacturing, localizing the supply chain, and strengthening its balance sheet through debt reduction and investment in studies and development.

The Boat share price has appreciated significantly from ~₹1,300 in early 2024 to its current level near ₹1,535, signaling growing confidence in the brand’s valuation.

Market Performance

Despite a mentioned slowdown in wearable tool and device shipments in India, with an 8.7% year-on-year fall in Q4 FY24, boAt has maintained a giant market share. As of mid-2024, boAt held and positioned itself strong by attaining substantial market shares of 42% in audio devices and on the other side 26.7% in wearables. The enterprise's commercial business approach leverages a robust online presence, specially on e-commerce systems like Amazon and Flipkart, alongside an expanding offline retail footprint. Notably, in FY 2024, boAt experienced a shift with offline sales growth and good surge that have surpassed online sales, projecting to account for about one-third of its total sales.

What’s Behind boAt’s Expansion Strategy?

To regain momentum, boAt is pushing deeper into offline retail, mainly in Tier 2 and Tier 3 cities, even as continuing worldwide outreach into the Middle East and Southeast Asia. The audio phase still accounts for about 80% of sales and remains its most powerful growth pillar. The company is streamlining marketing costs and warranty expenses to enhance margins in FY25.

Conclusion

For investors interested in Imagine Marketing, the boAt unlisted share price has been a point of interest, with prices around ₹1,560 to ₹1,659 per equity share recently. The valuation of boAt with a potential target range of $1.5 billion closer to the IPO filing. The minimum ticket size for investment in Imagine Marketing's unlisted shares is currently between ₹35,000 to ₹43,000. While there is no official announcement from the stock exchanges regarding the boAt IPO date, industry norms suggest that the final launch could be in mid-to-late 2025, following SEBI's review and observations. The success of this IPO could establish a trend for other consumer electronics firms in the Indian market.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.