DRHP Submissions Surge to 10-Year Peak in 2025 Amid muted IPO Listings

Sep 16, 2025

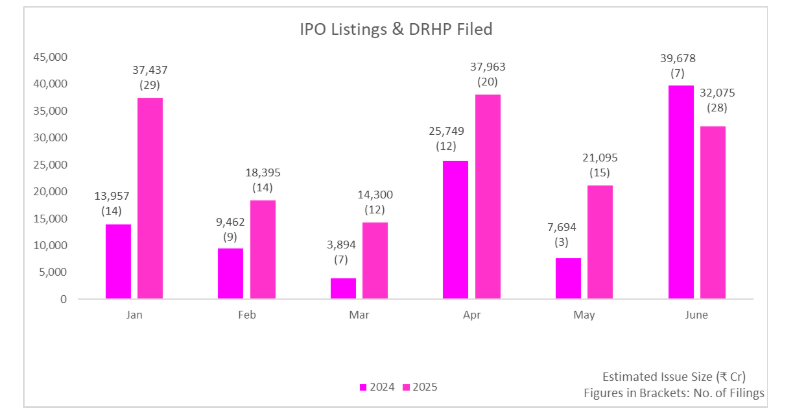

In 2025, India's capital markets have shown an interesting paradox: while the IPO listing remains sluggish, drafts have exploded in the filing of draft red herring prospectus (DRHPS), which reaches the numbers not seen in ten years. This boom in DRHP submission suggests that companies are preparing the basis for potential rebounds in public market activity, even as the situations are challenging.

The Unwavering Optimism in DRHP Filings

Between January and May 2025, a notable 85 companies presented their DRHPS to the Securities and Exchange Board of India (SEBI). This figure not only marks a sufficient increase, but also represents the highest number recorded for this specific five -month period in a decade. The outer volume of these submissions underlines a strong pipeline of companies preparing to tap public markets, which reflects long -term development prospects and constant confidence in the viability of public money.

A DRHP IPO acts as a fundamental document in the process, describing important information about the company, its financial health, business operations and the specifics of the proposed stock proposal. The task of filing DRHP is a significant commitment, requiring adequate efforts and resources. Therefore, the constant high amounts of these filing suggest that a large number of businesses keep themselves in position for the future public listing, which indicates an optimistic approach on further market conditions.

Notable companies that have already made their intentions clear by filing DRHPs during this period include financial services giant Tata Capital, Groww, Pine Labs, Physicswallah, Pace Digitek, Hero Fincorp, OYO and asset management firm Canara Robeco Asset Management. The diverse nature of these companies, spanning and extending into various sectors, further illustrates the broad-based intent to access public capital.

IPO Market's Muted Performance

Unlike the strong DRHP pipeline, the actual number of IPO listings in 2025 is relatively muted and around some minimum. This deviation highlights a cautious approach by companies, which is affected by potentially prevalent market conditions. While the intention of going public is strong, the execution of these schemes and plans in successful listing is subject to various external factors.

The recession, instability in broader equity markets, characterized by volatility and investor circumspection, seems to be an important contributor to the muted IPO activity within wider equity markets. When the secondary markets experience pressure or increased uncertainty at the bottom, investors' appetite may decrease or diminish in the new listing. Potential investors may prefer to hold existing, more liquid assets or wait for more market stability before giving capital for new, unproven offerings.

In addition, primary activity can create a common slowdown that includes not only IPOs, but other forms of issuing new capital can also create a less favorable environment for companies seeking public. This may be due to a combination of factors, including high interest rates, strict credit status, or comprehensive economic recession affecting corporate earnings and valuations.

Driving Factors Behind the DRHP Surge

Several factors could be contributing to this surge in DRHP submissions, even amidst a quieter IPO market:

Anticipation of Future Market Improvement: Companies and their advisors DRHPS can be filed with anticipation that the market conditions will improve in the moderate period. The IPO process is long, often carries from DRHP filing to the actual listing from several months to one year. Now by filing, companies are positioning themselves to capitalize on the potentially more favorable market window in future.

Regulatory Clarity and Ease of Doing Business: Continuous efforts by regulatory bodies such as SEBI regarding to streamline the IPO process can also encourage more companies to further push for this path to consider public listing. A more approximate and efficient regulatory environment may reduce the perceived obstacles to entry for companies considering an IPO.

Valuation Expectations: Companies can now file DRHP, which now reflect their current development trajectory, even if the immediate listing environment is challenging. They may be ready to wait for better market conditions to ensure optimal pricing for their offerings.

Conclusion

The data for 2025 paint a compelling picture: DRHP submission to a high level of decade, large amount to raise capital, and strong corporate confidence even in front of macroeconomic headwinds. While the actual IPO listing is lagging behind, the current filing boom shows that companies are preparing themselves for more favorable windows, creating positions, and preparing themselves.

For investors, it means potential advantage but also requires selective thorough due diligence. For regulators and market intermediaries, this means that the infrastructure (disclosures, approval, pricing, investor protection) should be faster. And for companies, this means that the time for the construction of narratives with the substance because the demand may suddenly return, but being underprepared can cost the valuation and investor trust.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.