Sebi Nod Groww IPO: India’s Largest Stockbroker Heads for a Landmark Market Debut

Sep 1, 2025

Groww, India's largest stockbroker, has received approval from the Securities and Exchange Board of India (SEBI) for its Initial Public Offering (IPO), signalling a landmark market debut for the fintech company. The IPO is expected to raise between $700 million and $1 billion, potentially valuing Groww at around $7 billion.

From Startup to Stock Market Giant

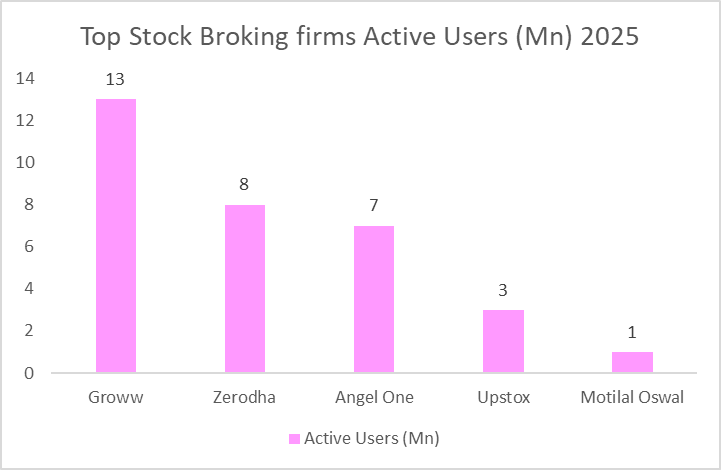

Groww began as a mutual fund investment platform but has since expanded into equities, ETFs, and fixed deposits, emerging as the largest stockbroker in India by active users. Its mobile-first, simple interface attracted millions of first-time investors who were underserved by traditional brokerages. Over time, Groww has built an ecosystem that now caters to over ~13 million active users, transforming retail participation in Indian markets.

The company has also attracted heavyweight global investors such as Tiger Global, Peak XV Partners (formerly Sequoia Capital India), Ribbit Capital, ICONIQ Growth, and Y Combinator, who backed its rise from a small fintech to a unicorn. Many of these backers are expected to partially offload shares through the IPO’s offer-for-sale (OFS) route, while the fresh issue will fund Groww’s expansion.

Groww aims to transition from primarily a discount broker to a comprehensive wealth management platform. This strategy includes product expansion into wealth management and advisory through acquisitions, such as the all-cash deal to acquire Fisdom for approximately $150 million in May 2025. The IPO proceeds are intended to be utilised for technology development and business expansion.

Groww IPO Details

Groww's parent company, Billionbrains Garage Ventures Pvt. Ltd., confidentially filed its draft red herring prospectus (DRHP) with SEBI on May 26. This confidential pre-filing route, which allows companies to withhold public disclosure of IPO details until later stages, is gaining traction among Indian firms seeking flexibility. The IPO will comprise a combination of fresh equity shares and an offer for sale (OFS) component. Groww has appointed JPMorgan Chase & Co., Kotak Mahindra Bank Ltd, Citigroup Global Markets Private Ltd, Axis Capital Ltd, and Motilal Oswal Securities Ltd as the bankers to manage the offering. The equity shares will have a face value of ₹2 each and are planned to be listed on both the National Stock Exchange (NSE) and the BSE.

Groww IPO: Financial Performance

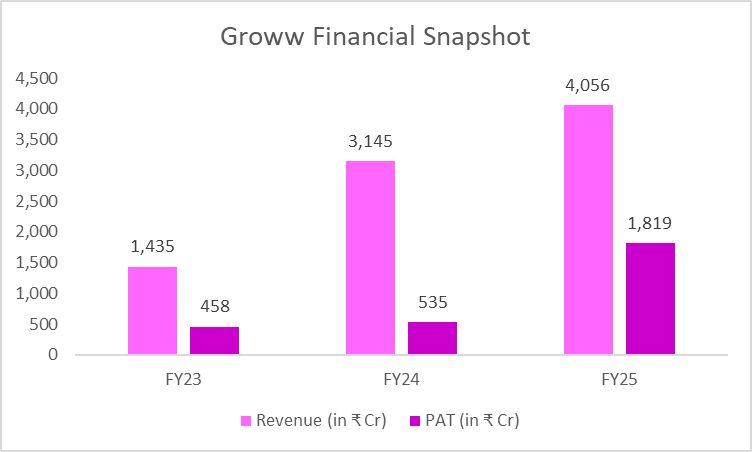

The IPO comes on the back of impressive financial performance. In FY25, Groww posted a net profit of ₹1,819 crore, a threefold jump compared to the previous year, and along with revenue surpassing 31% to ₹4,056 crore in FY25 and earlier in FY24 it was ₹3,145 crore and with a profit of ₹535 crore. This sharp turnaround highlights the company’s operational discipline and scale-driven profitability.

But the journey wasn’t without challenges. The company completed a reverse flip of its holding entity from the United States to India, aligning itself with SEBI’s IPO requirements. That move incurred a one-time tax outgo of ₹1,340 crore, pulling its books into the red despite healthy operating profits. This restructuring now ensures that Groww’s corporate headquarters and regulatory oversight remain firmly rooted in India.

Market Dynamics and Challenges

The IPO comes amid a broader slowdown in India's discount brokerage sector, which saw leading players like Groww, Zerodha, Angel One, and Upstox lose nearly 2 million active investors in the first half of 2025. Groww alone shed 600,000 clients during this period. This decline is partly attributed to SEBI's tighter regulations on derivatives trading, including stricter margin rules, shorter contract expiries, tighter eligibility requirements, and higher taxes, which have impacted casual traders.

Despite these headwinds, industry experts view this as an industry-wide adjustment and anticipate renewed activity in the long term, citing the digital-first ecosystem and increasing financialization of assets. They also note that retail volumes historically shrink during volatile phases, but significant growth over the past five years and early equity penetration in urban and semi-urban India suggest ample opportunities ahead.

Regulatory Compliance and Future Outlook

Groww's decision to utilize the confidential pre-filing route for its DRHP allows for regulatory feedback without early exposure of sensitive financial details. This route also provides a longer window of 18 months for launching the IPO after receiving SEBI's final comments, compared to the 12-month window for traditional filings, and allows for modifications to the primary issue size. SEBI's approval is seen as a positive sign for fintech models and the maturity of Indian capital markets, which are increasingly open to domestic listings of new-economy companies.

Despite strong fundamentals, Groww faces risks such as market volatility, ongoing regulatory oversight on fintech, and competitive pricing pressures in the commoditizing discount broking sector. Post-listing, Groww plans to expand into wealth management, insurance, and lending, aiming to become a comprehensive financial services "super-app". The IPO is expected to be a significant test case for the Indian public markets' readiness to absorb large, profitable fintech companies. The move to diversify revenue streams, particularly through mutual funds and systematic investment plans, is expected to help shield Groww from downturns in stock trading.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.