Studds Accessories IPO Opens October 30; Everything You Need Before Investing

Oct 29, 2025

Helmets Off to India: How Studds Is Powering the Next Gear of the Safety Revolution

On a humid morning in Haryana, a pallet of glossy helmets rolls off the Studds production line, destined for a dealer in Pune, a distributor in Germany, and an online order for a rider in Bengaluru. That single pallet captures the arc of India’s helmet industry today: domestic safety rules, soaring two-wheeler demand, growing exports, rising product sophistication, and a geopolitical backdrop that both complicates and creates opportunity.

Studds Accessories Ltd, a household name in rider safety and one of India’s largest helmet makers, is back in the public eye. The Studds Accessories IPO opens on October 30, 2025 and closes November 3, with a price band of ₹557–₹585 and a lot size of 25 shares. But this is not a typical fundraising: the issue is entirely an Offer-for-Sale (OFS) by existing shareholders.

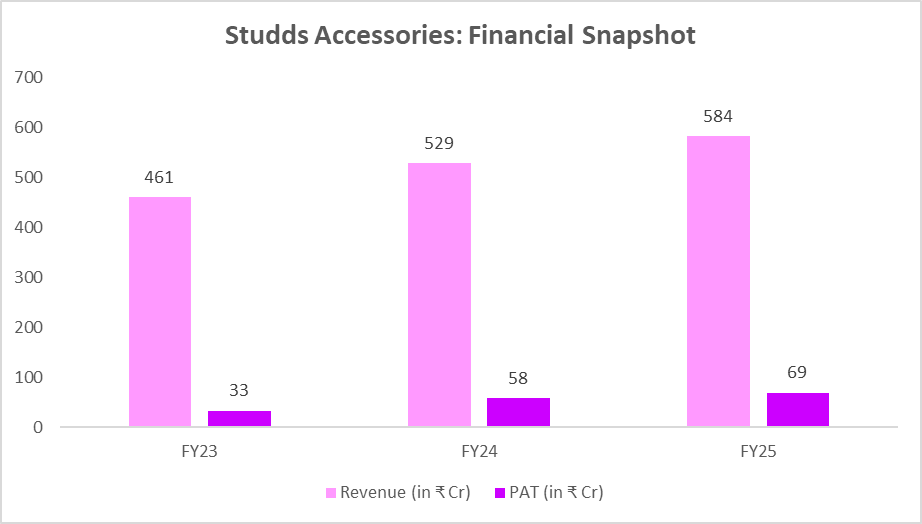

The Studds snapshot: scale and momentum

Studds Accessories, long the industry’s flagship, has moved beyond regional players to a national export champion. In FY25, the company reported roughly ₹585 crore of revenue (reporting band varies by source) and a net profit of about ₹70 crore, registering double-digit profit growth and healthy margin expansion year-on-year. The firm sold millions of helmets in FY25 and is now preparing an IPO, underscoring both scale and investor appetite.

Studds matters because it proves two things: (a) helmet manufacturing in India can be a high-volume, profitable, organized business; and (b) the sector has matured from fragmented, largely unbranded production into a branded, export-oriented industry with global reach.

The margin expansion shows improved cost control and stronger pricing in premium products. The company’s export mix and high-margin SMK brand are likely helping drive this profitability. In a market where regulatory safety standards are tightening and consumers are shifting toward branded, certified helmets, Studds stands to benefit from both policy and preference tailwinds.

The industry pulse: demand, numbers and product change

Market studies point to steady mid-single-digit to high-single-digit growth for India’s helmet markets. Estimates put the two-wheeler helmet market growing at a ~6–9% CAGR over the coming five years, with the broader motorcycle/safety helmet space projected to expand significantly by 2030 as vehicle ownership and safety awareness rise. Separate “smart helmet” segments are set to grow even faster, reflecting new features and higher ASPs. Why this growth? Four simple forces:

Two-wheeler recovery & urban mobility — India still adds millions of two-wheelers each year; more riders = more helmets.

Safety enforcement & campaigns — local administrations are increasingly strict (some districts enforcing “no helmet, no petrol” and state road-safety targets), nudging helmet compliance higher.

Premiumisation — riders are trading up to full-face, ventilated, and smart helmets for comfort and safety; manufacturers capture better margins.

Export demand — Indian makers are finding buyers abroad, especially as global supply chains re-route away from China.

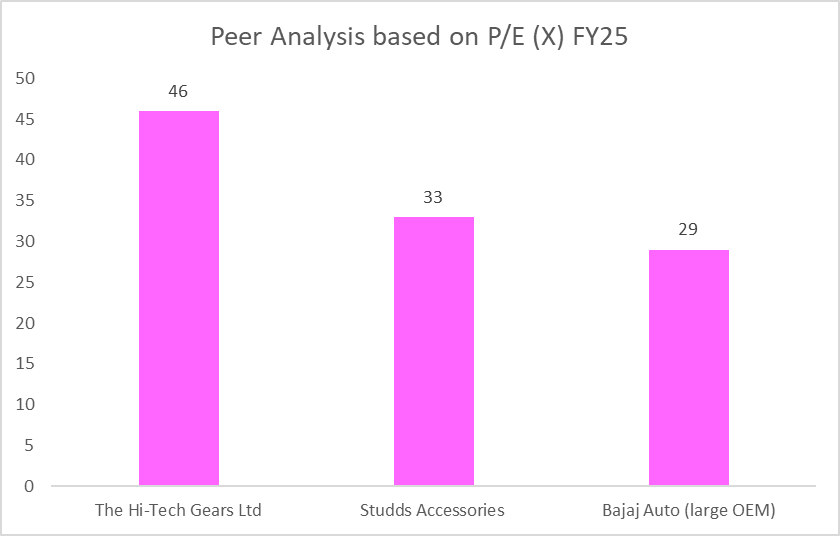

Studds Accessories: Peers Analysis

The geopolitics: risk and opportunity

Geopolitics cut both ways for India’s helmet makers.

On the opportunity side, the global “China+1” reconfiguration of supply chains and recent U.S./global tariffs have nudged multinational buyers to diversify away from China — opening export windows for capable Indian manufacturers. The Foxconn/Apple example in electronics shows how quickly production footprints can move when tariffs bite; helmets and safety equipment are similarly portable categories for sourcing.

On the risk side, escalating trade tensions and tariff changes are unpredictable. Recent tariff shocks and trade negotiations (U.S. tariff measures and broader trade frictions in 2025) mean Indian exporters may face new duties or retaliatory barriers that could blunt near-term export gains. Manufacturers with concentrated export markets or thin pricing power would be most exposed.

Supply chain realities: materials and margins

Helmet shells and cores depend on polymers (ABS, polycarbonate) and EPS foam — materials whose prices and availability matter. India’s helmet industry sources these resins both domestically and via imports; volatility in polymer pricing or supply disruptions can pressure margins, especially for firms that compete on price rather than design or brand. Producers who secure raw-material partnerships or backward-integrate (or who can pass through costs) will weather shocks better.

Looking ahead: where the road leads

The industry thesis is straightforward but nuanced: structural demand + enforcement + premiumisation + exports = multi-year growth, but performance will diverge between players. Studds show what scale, brand and distribution can deliver — stable revenue growth, margin expansion and global reach. Smaller firms with clear niches or OEM linkages can also prosper, especially if they invest in design, compliance and export readiness. Currently studds accessories share price is trading around ₹629 per share in the unlisted market and gaining significant attention . The current grey market presented the studds accessories GMP is around 12-15%.

Key watch-items for investors and industry watchers:

OFS = promoter exit: This IPO is a selling-shareholders’ exit, not new capital for growth. That changes the risk/return — you’re buying secondary shares, not funding expansion. Understand which promoters/investors are exciting and why.

Cyclical demand: Helmets tie to two-wheeler sales and discretionary upgrades (premium helmets); a slowdown in vehicle demand or aggressive discount cycles can pressure volumes and margins.

Competitive & margin pressure: Large e-commerce discounts, low-price local players, and rising input costs (composite materials) can compress margins.

Regulation & quality risk: Any product safety lapses or regulatory non-compliance can hit sales and brand value disproportionately.

Conclusion

Studds is a recognisable, scaled player in a large, structurally steady market. The IPO gives public market access to a strong consumer/industrial brand, but it’s an exit route for sellers, not fresh capital for the company. That distinction is crucial: you are buying into current ownership being trimmed. If you believe in Studds’ brand moat, distribution reach and long-term market growth, treat this as a long-term play.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.