Planify Feed

Date: Mon 23 Feb, 2026

Financial Performance (Q3 FY26 vs Q3 FY25): Parag Parikh Financial Advisory Services Ltd reported a robust financial performance in Q3 FY26, with Total Income increasing by 66.42% year-on-year (YoY) to ₹169.35 crore, compared to ₹101.8 crore in Q3 FY25. This strong top line growth reflects expansion in the company’s core asset management and advisory operations, supported by higher fee income and investment-related gains. The company delivered substantial profitability growth, with Profit Before Tax rising to ₹131.12 crore, up from ₹84.53 crore in the corresponding quarter last year. Profit After Tax (PAT) also increased significantly to ₹98.64 crore, compared to ₹50.98 crore in Q3 FY25, reflecting strong operating leverage and improved earnings momentum.

Operational Metrics (Q3 FY26 vs Q3 FY25): PPFAS’s revenue growth was primarily driven by strong performance across its fee-based income streams. Fee and commission income rose sharply to ₹151.62 crore in Q3 FY26, compared to ₹101.18 crore in Q3 FY25, highlighting sustained growth in assets under management and advisory mandates. Net gain on fair value changes also increased significantly to ₹17.59 crore, up from ₹0.54 crore in the previous year, further supporting overall income growth. Despite higher employee and operating expenses in line with business expansion, the company maintained strong profitability, reflecting the scalability and efficiency of its asset-light business model.

Strategic Developments & Outlook: PPFAS continues to benefit from structural tailwinds in the asset management industry, supported by rising investor participation and growth in managed assets. The company’s strong increase in fee-based income and fair value gains highlights improving operational momentum and earnings visibility. With its scalable platform, strong profitability profile, and consistent growth in core income streams, PPFAS remains well-positioned to sustain its financial performance. Continued expansion in its asset management and advisory businesses is expected to support long-term revenue growth and enhance shareholder value.

Date: Mon 23 Feb, 2026

Financial Performance (Q3 FY26 vs Q3 FY25): Frick India Ltd reported a steady financial performance in Q3 FY26, with Total Income increasing by 7.64% year-on-year (YoY) to ₹136.97 crore, compared to ₹127.58 crore in Q3 FY25. This top line growth reflects stable demand for the company’s industrial refrigeration and air conditioning systems and continued execution across its core business segments. The company reported a Profit Before Exceptional Items and Tax of ₹14.36 crore, compared to ₹13.70 crore in the corresponding quarter last year. However, Profit After Tax (PAT) declined to ₹8.28 crore, compared to ₹10.49 crore in Q3 FY25, primarily due to the impact of an exceptional expense of ₹3.22 crore recorded during the quarter related to labour code provisions

Operational Metrics (Q3 FY26 vs Q3 FY25): Frick India’s revenue growth was driven by continued strength in its core manufacturing operations. Revenue from Operations increased to ₹133.91 crore in Q3 FY26, compared to ₹125.12 crore in Q3 FY25, reflecting stable order execution and demand momentum. Other Income also improved to ₹3.06 crore from ₹2.45 crore in the previous year, supporting overall income growth. On the cost front, total expenses increased to ₹122.62 crore, compared to ₹113.88 crore in Q3 FY25, primarily due to higher material consumption and employee-related costs in line with business expansion. Despite the exceptional expense impact, the company maintained operational profitability, highlighting the resilience of its core business model.

Strategic Developments & Outlook: Frick India continues to strengthen its operational capabilities while adapting to regulatory changes, including the implementation of new labour codes, which resulted in a one-time exceptional expense during the quarter. The company remains focused on improving efficiency, executing its order book, and enhancing profitability. With its established presence in industrial refrigeration and continued demand from core industrial sectors, Frick India remains well-positioned to sustain stable revenue growth over the long term. Its strong manufacturing capabilities and industry positioning are expected to support continued operational performance and shareholder value creation.

Date: Tue 17 Feb, 2026

Financial Performance (Q3 FY26 vs Q3 FY25): Schneider Electric President Systems Limited reported a steady revenue performance in Q3 FY26, though bottom-line figures were impacted by a one-time regulatory charge. Total revenue from operations increased by 4.9% year-on-year (YoY) to ₹115.49 Crore, compared to ₹110.07 Crore in Q3 FY25. Total income (including other income) stood at ₹117.28 Crore for the quarter, slightly lower than the ₹120.73 Crore recorded in the corresponding period last year due to a dip in other income. Profit After Tax (PAT) declined by 13.2% YoY to ₹12.14 Crore, compared with ₹13.98 Crore in Q3 FY25. This decrease was primarily driven by a non-recurring exceptional item of ₹4.56 Crore related to new labor code provisions. Earnings Per Share (EPS), restated for the bonus issue, stood at ₹10.04 compared to ₹11.50 in the previous year's third quarter.

Operational Metrics (Q3 FY26 vs Q3 FY25): Operational results reflected significant shifts in cost structures and capital base during the quarter. Total expenses (excluding tax and exceptional items) were optimized at ₹96.09 Crore, down from ₹101.01 Crore a year ago, largely aided by a ₹7.50 Crore credit from changes in inventories. Cost of raw materials and components consumed rose to ₹80.10 Crore from ₹76.11 Crore YoY. The company's paid-up equity share capital doubled to ₹12.10 Crore from ₹6.05 Crore following a 1:1 bonus share allotment. Despite the exceptional charge, the company maintained a healthy Profit Before Tax (PBT) margin (before exceptional items) of approximately 18.3% of revenue from operations.

Strategic Developments: During the quarter, Schneider Electric President Systems Limited reached a major corporate milestone by completing a 1:1 bonus issue, allotting 6,048,000 equity shares to eligible members. This move, funded through the Securities Premium Account, increased the total paid-up equity capital to ₹12.10 Crore. A significant strategic impact was the recognition of ₹4.56 Crore as an exceptional item. This charge represents the estimated incremental impact on gratuity following the Government of India's notification of four new Labour Codes on November 21, 2025. The management continues to monitor the finalization of state rules regarding these codes to provide further accounting treatments as required. Furthermore, the company maintains its focus on a single primary business segment involving products and systems for electricity distribution.

Date: Tue 17 Feb, 2026

Financial Performance (Q3 FY26 vs Q3 FY25): Midland Microfin Limited reported a strong improvement in profitability in Q3 FY26, supported by higher operational revenue and fee income. Total revenue from operations increased by 10.3% year-on-year (YoY) to ₹1,657.43 million, compared to ₹1,503.14 million in Q3 FY25, driven by growth in interest income and fees

Operational Metrics (Q3 FY26 vs Q3 FY25): Operational performance remained resilient during the quarter. The net profit margin stood at 4.94%, reflecting the company's ability to maintain margins amidst operational costs

Strategic Developments: During the quarter, Midland Microfin Limited continued to focus on expanding its lending activities, utilizing proceeds from the issuance of secured and unsecured Non-Convertible Debentures (NCDs) primarily for onward lending

Date: Tue 17 Feb, 2026

Financial Performance (Q3 FY26 vs Q3 FY25): NCL Buildtek Ltd reported a steady financial performance in Q3 FY26, with Revenue from Operations increasing by 9.54% year-on-year (YoY) to ₹106.17 crore, compared to ₹96.92 crore in Q3 FY25

Operational Metrics (Q3 FY26 vs Q3 FY25): The Windoors segment anchored the growth momentum with revenue climbing 12.7% YoY to ₹53.14 crore (up from ₹47.15 crore), accompanied by a sharp rise in segment profit to ₹2.67 crore from ₹0.78 crore in the prior year

Strategic Developments & Outlook: NCL Buildtek’s focus on financial discipline is evident in its improved solvency ratios. The Consolidated Debt-Equity Ratio improved to 0.16 in Q3 FY26 from 0.27 in the corresponding quarter of the previous year

Date: Tue 17 Feb, 2026

- Financial Performance (Q3FY26 vs Q3FY25): In Q3FY26, NCDEX reported a YoY improvement in total income, supported by higher operating revenue and a sharp increase in other income. Total income stood at ₹46.61 Cr, compared with ₹30.47 Cr in Q3FY25, reflecting improved treasury income and recovery in core operating revenues. Revenue from operations increased to ₹25.46 Cr, from ₹21.59 Cr in Q3FY25, while other income rose significantly to ₹21.15 Cr, compared with ₹8.88 Cr in the corresponding quarter last year.Despite the improvement in income, operating performance remained under pressure due to elevated cost structures. Total expenses increased to ₹59.54 Cr, compared with ₹49.00 Cr in Q3FY25, driven primarily by higher employee benefit expenses and other operating costs.As a result, Profit Before Tax (PBT) stood at a loss of ₹(13.59) Cr, compared with a loss of ₹(18.53) Cr in Q3FY25, reflecting a narrowing of losses on a YoY basis.After accounting for tax adjustments, NCDEX reported a Net Loss of ₹(6.41) Cr, significantly lower than the Net Loss of ₹(11.80) Cr in Q3FY25, indicating partial improvement in profitability. Consequently, Earnings Per Share (EPS) improved to ₹(0.89), from ₹(2.29) in the corresponding quarter last year.For 9MFY26, total income increased to ₹108.24 Cr, compared with ₹83.00 Cr in 9MFY25, reflecting improved overall income generation during the year. However, Net Loss widened to ₹(36.43) Cr, compared with ₹(34.83) Cr in 9MFY25, highlighting continued profitability challenges despite revenue improvement.

- Operational Metrics (Q3FY26 vs Q3FY25): Profitability metrics remained under stress, although losses narrowed meaningfully on a YoY basis due to higher income growth. The improvement in revenue from operations reflects some stabilisation in trading activity, while the sharp increase in other income provided additional support to overall earnings.However, cost pressures remained elevated, with total expenses rising 21.5% YoY, driven primarily by:

- Higher employee benefit expenses

- Increased administrative and operational costs

Total comprehensive loss improved to ₹(6.87) Cr, compared with ₹(12.16) Cr in Q3FY25, reflecting the overall improvement in earnings performance.The exchange’s reserves remained stable at ₹673.71 Cr, indicating a strong capital base to absorb ongoing losses.

- Strategic Developments: During 9MFY26, NCDEX continued to focus on strengthening its operating performance and market position through:

- Efforts to improve trading participation and liquidity

- Optimisation of cost structures

- Enhancing treasury income through efficient fund deployment

- While Q3FY26 reflected meaningful narrowing of losses and strong income growth, profitability remains constrained due to structural challenges in commodity derivatives trading and high fixed operating costs. However, improving revenue trends, stable reserves, and narrowing quarterly losses provide some comfort. Sustained recovery in trading volumes and operating leverage will be critical to restoring profitability over the medium term.

Date: Mon 16 Feb, 2026

Amid market reports regarding a potential initial public offering (IPO), the Chennai Bench of the National Company Law Tribunal (NCLT) has issued notice to Polymatech Electronics Limited over an insolvency petition alleging a default of Rs 157.20 crore.

The petition, filed under the Insolvency and Bankruptcy Code (IBC) by operational creditors, seeks initiation of the Corporate Insolvency Resolution Process (CIRP) against the company. The creditors have alleged that Polymatech failed to clear advisory fees and honour certain equity commitments despite repeated assurances and partial payments. Submissions before the tribunal indicate that while portions of the outstanding amount were acknowledged and part-payments were made, the balance dues remain unpaid.

The petitioners were represented by Senior Advocate P.V. Balasubramaniam along with Advocates Aditya Bharat Manubarwala and Amogh Simha. They informed the tribunal that a statutory demand notice was issued in January 2025, and that no formal reply was received within the stipulated period. The petitioners further contended that the company’s partial payments constitute acknowledgment of liability under applicable law.

Advocate Roshan appeared on behalf of Polymatech Electronics Limited and accepted notice for the corporate debtor. Following preliminary submissions, the NCLT issued notice in the matter and listed it for further hearing on March 26, 2026.

If admitted, the plea could result in the appointment of an Interim Resolution Professional and the commencement of CIRP, potentially impacting management control, operational continuity, and stakeholder interests. The matter is now slated for further consideration on the scheduled date.

Date: Mon 16 Feb, 2026

InSolare Energy has been awarded a repeat Engineering, Procurement & Construction (EPC) contract for a 50 MW AC / 70 MWp DC utility-scale solar project in Jaitpur, Uttar Pradesh, by a leading renewable energy developer.

This new order underscores InSolare’s execution strength and deepening client trust, reflecting its ability to deliver large-scale solar infrastructure with consistency and quality in India’s competitive clean energy market.

The project’s 70 MWp DC capacity refers to the total solar panel generation potential, while 50 MW AC denotes the grid-export capacity after conversion — a structure that optimises energy yield and performance efficiency.

Securing a repeat mandate from an established developer highlights InSolare’s operational reliability, timely delivery, and strong on-ground execution capabilities — key differentiators in the EPC segment where trust and performance often drive future business.

The Jaitpur solar project also strengthens InSolare’s order pipeline and regional presence in northern India, contributing to its broader ambitions in utility-scale solar deployment. The award will support the company’s revenue visibility and backlog growth over the execution period.

This development aligns with India’s aggressive renewable energy goals and expanding solar capacity targets, as the country progresses toward a cleaner, low-carbon energy mix.

InSolare continues to build on its reputation as a trusted EPC partner, reinforcing its role in India’s energy transition and sustainable infrastructure growth.

Date: Fri 13 Feb, 2026

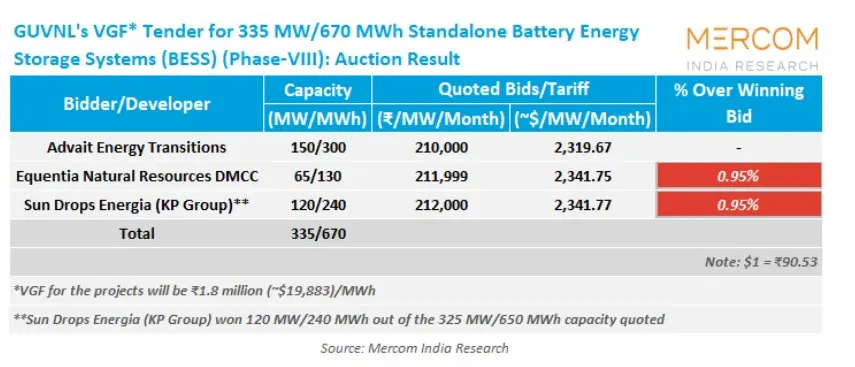

The recent Union Budget has made one thing clear — Battery Energy Storage Systems (BESS) are becoming a national priority. With customs duty benefits and policy support aimed at strengthening the domestic storage ecosystem, the government is actively encouraging large-scale adoption of energy storage solutions.

Against this strong policy backdrop, Sundrops Energia Pvt. Ltd. has secured a 120 MW / 240 MWh BESS project in GUVNL’s 670 MWh auction, as reported by Mercom India.

This is more than just a project win. It marks Sundrops Energia’s clear entry into large-scale battery storage — a segment expected to grow rapidly as India increases its renewable energy capacity.

As solar and wind installations expand, storage becomes essential to:

Store excess power generated during peak hours

Supply electricity when demand is high

Improve grid stability

Enable round-the-clock renewable energy

By securing this project at a time when policy support and market demand are both strengthening, Sundrops Energia is aligning itself with the next phase of India’s clean energy growth.

With supportive government measures and execution already underway, the company is positioning itself to participate meaningfully in India’s fast-evolving energy storage landscape.

For more details on the auction results, you can read the full coverage on Mercom India.

Advait Energy, Equentia, Sun Drops Win GUVNL’s 670 MWh BESS Auction

Date: Wed 11 Feb, 2026

Founded in the year 2000, Fractal Analytics Limited is a global provider of artificial intelligence and advanced analytics solutions, operating at the intersection of AI, data science, decision intelligence, and digital transformation. The company supports enterprises worldwide in leveraging data to drive better business outcomes and has built a strong international presence over more than two decades by delivering analytics-led platforms and solutions across industries.

Fractal Analytics is now preparing to enter the public markets with its proposed Initial Public Offering (IPO) aggregating to ₹2,833.9 crore,

The offer comprises a fresh issue of ₹1,023.5 crore and an offer for sale of ₹1,810.4 crore by existing shareholders.

The issue is being offered through a 100% book-building process, with equity shares of face value ₹1 each proposed to be listed on the NSE and BSE. The IPO is scheduled to open on February 9, 2026, and close on February 11, 2026, with anchor investor bidding on February 6, 2026. The pre-IPO & Post IPO promoters’ holdings stand at 18% & 16.05% respectively.

Business Model and Operating Footprint

The company primarily operates on a Business-to-Business (B2B) model, working closely with large global enterprises to deliver artificial intelligence, advanced analytics, and decision intelligence solutions. The company serves clients across multiple industries and geographies, with a strong international footprint reflecting its global delivery and client engagement model. Fractal’s operating approach is centred on embedding analytics deeply into client decision-making processes, enabling long-term, high-value engagements rather than one-off projects. A key strategic strength lies in its ability to integrate data science, AI models, and domain expertise into scalable platforms and solutions, allowing it to support complex, mission-critical use cases for large enterprises worldwide.

Capex and Future Growth Drivers

The proceeds from the fresh issue are intended to support Fractal Analytics’ next phase of growth as demand for AI-led decision intelligence continues to scale globally. Given the company’s technology-driven and solution-oriented business model, the Net Proceeds are proposed to be utilised primarily towards:

• Investment in growth initiatives- It includes strengthening product capabilities, technology platforms, and expanding AI and analytics solutions across key enterprise use cases.

• Enhancing operational scale and flexibility- Enabling the company to support large, long-term client engagements and global delivery requirements.

• General corporate purposes- it involves strategic initiatives, operational needs, and improving overall financial and organisational resilience.

Date: Tue 10 Feb, 2026

Originally incorporated in 2010 as Marushika Traders and Advisors Private Limited, Marushika Technology Limited (MTL) has evolved into a specialized distributor and service provider of Information Technology (IT) and Telecom Infrastructure solutions. The company provides a comprehensive suite of digital infrastructure services, including data center setup, active networking, cybersecurity, advanced surveillance systems, and power management. Its diversified operations also include smart solutions such as smart lighting and waste management and a recently expanded Auto-tech division dedicated to the maintenance and refurbishment of military vehicles for the defense sector.

The company is now launching an Initial Public Offering (IPO) of up to 23,05,200 Equity Shares of face value Rs10 each to raise ₹26.97 crore, entirely through a fresh issue. Marushika Technology IPO price band is set at ₹111 to ₹117 per share. The lot size for an application is 1,200. The minimum amount of investment required by an individual investor (retail) is ₹2,80,800 (2,400 shares) (based on upper price). The minimum lot size for investment in HNI is 3 lots (3,600 shares), amounting to ₹4,21,200. IPO will list on NSE SME with a tentative listing date fixed as Feb 19, 2026.

Business Model and Operating Footprint

Marushika Technology Limited operates primarily on Business-to-Business (B2B) and Business-to-Government (B2G) models, serving as a critical link between Original Equipment Manufacturers (OEMs) and end-users. The company has a significant operational presence in Delhi and Uttar Pradesh, which collectively contributed over 61% of its total revenue in the most recent stub period.A key strategic pillar is its "Bill-to-Ship" model, which streamlines logistics by having products delivered directly from suppliers to client project sites, thereby optimizing execution timelines and reducing handling costs. MTL's ability to integrate diverse technologies from smart access controls to integrated command centers enables it to serve high-profile government entities such as Bharat Electronics Limited (BEL) and the Delhi Metro Rail Corporation (DMRC).

Capex and Future Growth Drivers

The proceeds from the IPO are essential for MTL to scale its operations in the capital-intensive IT infrastructure and defense technology sectors. The Net Proceeds are primarily earmarked for:

- Funding Working Capital Requirements: Approximately ₹1,468.00 Lakhs to support project execution and trade receivables.

- Repayment of Borrowings: Approximately ₹500.00 Lakhs to reduce indebtedness and improve the balance sheet.

- General Corporate Purposes: To support business expansion and operational exigencies.

Date: Tue 10 Feb, 2026

- Financial Performance (Q3FY26 vs Q3FY25): In Q3FY26, Hero FinCorp reported a YoY decline in total income, driven by pressure on interest income. Total income stood at ₹2,160.05 Cr, compared with ₹2,306.4 Cr in Q3FY25, reflecting moderation in lending yields amid a tight interest rate environment. Interest income declined to ₹1,837.6 Cr, while total revenue from operations was largely in line with total income during the quarter. Operating performance weakened significantly, with Profit Before Tax (PBT) widening to a loss of ₹103 Cr, compared with a loss of ₹11.9 Cr in Q3FY25. The deterioration was primarily driven by higher impairment on financial instruments, which increased sharply to ₹604.5 Cr, alongside elevated finance costs of ₹807.01 Cr. After tax, the company reported a Net Loss of ₹121.7 Cr, versus a Net Loss of ₹32.4 Cr in Q3FY25. Consequently, Earnings Per Share (EPS) declined further to ₹(9.4) from ₹(2.55) in the corresponding quarter last year. For 9MFY26, total income stood at ₹6,634.13 Cr, marginally lower on a YoY basis, while Net Loss widened to ₹284.2 Cr, compared with a profit of ₹33.6 Cr in 9MFY25, underscoring sustained profitability pressure through the fiscal year.

- Operational Metrics (Q3FY26 vs Q3FY25): Profitability metrics remained under stress, with net profit margin at -8.0%, reflecting sustained pressure from credit costs and funding expenses. Asset quality weakened further, with Gross NPA (GNPA) rising to 5.89% (vs 4.98% YoY) and Net NPA (NNPA) increasing to 2.67% (vs 2.36% YoY), largely driven by stress in the MSME and unsecured personal loan segments. On a positive note, the Provision Coverage Ratio (PCR) improved to 58.42%, up from 54.61% YoY, strengthening loss absorption capacity. The company maintained a comfortable capital position, with CRAR at 17.29% (vs 16.54% YoY), while Liquidity Coverage Ratio (LCR) improved sharply to 153.8%, indicating strong liquidity buffers. Leverage remained stable, with total debt to total assets at ~86.7%, while Net Worth increased to ₹5,812.4 Cr, supported by retained capital and improved provisioning buffers.

- Strategic Developments: During 9MFY26, Hero FinCorp continued active balance-sheet churn, acquiring selective loan pools while transferring stressed accounts to improve portfolio quality. The company also raised ₹500 Cr through NCD issuances during Q3FY26, with proceeds fully utilized as per stated objectives, supporting liquidity and refinancing needs. Q3FY26 remained a challenging quarter, with losses deepening due to elevated impairments and high finance costs amid persistent asset quality stress. However, strong capital adequacy (17.3%), improving liquidity coverage, and a rising provision buffer provide downside protection. While near-term profitability remains under pressure, the declining resolution book, expected IPO-related capital infusion, and potential CCPS reclassification into equity are likely to support balance-sheet strength and moderate leverage over the medium term.

Date: Tue 10 Feb, 2026

- Financial Performance (Q3 FY26 vs Q3 FY25): SBI General Insurance Company Ltd reported a moderate improvement in profitability in Q3 FY26, supported by higher premium volumes and stable investment income. Net premium earned increased by 10.3% year-on-year (YoY) to ₹2,40,993 crore, compared to ₹2,18,516 crore in Q3 FY25, driven by growth across motor and health insurance segments. Total income (including investment income and other income) also improved during the quarter, aided by steady investment returns. Profit After Tax (PAT) rose by 12.2% YoY to ₹100.8 crore, compared with ₹89.8 crore in the corresponding quarter last year, reflecting better underwriting performance and controlled expense growth despite elevated claims in certain segments. Earnings Per Share (EPS) increased to ₹4.50 from ₹4.02 in Q3 FY25, indicating improved shareholder profitability.

- Operational Metrics (Q3 FY26 vs Q3 FY25): Operational performance remained mixed during the quarter. The net retention ratio stood at 63.9%, lower than 67.1% in Q3 FY25, reflecting higher reinsurance cessions amid portfolio diversification. The combined ratio remained elevated at 114.7%, compared to 113.8% a year ago, indicating continued underwriting pressure driven by higher claims in motor and health lines. Claims experience showed some stress, with the net incurred claims ratio at 76.4%, though this represented an improvement over historical averages. Expense management remained disciplined, while the company maintained a strong solvency position, with the solvency margin ratio stable at 2.12x, comfortably above regulatory requirements.

- Strategic Developments: During the quarter, SBI General Insurance continued to focus on portfolio diversification and disciplined underwriting, with steady growth in motor and health insurance segments offsetting softness in certain crop and weather-related lines. The company maintained a strong capital base, with net worth increasing to ₹5,181 crore, supported by retained earnings. While underwriting margins remained under pressure due to claims intensity and competitive pricing, stable profitability, strong solvency buffers, and improving scale provide resilience. Management remains focused on enhancing underwriting discipline, optimizing reinsurance structures, and improving operational efficiency to support sustainable profitability over the medium term.

Date: Tue 10 Feb, 2026

Originally incorporated in 2010 by Kuldeep Jain, a former McKinsey partner, Clean Max Enviro Energy Solutions Limited (CleanMax) has emerged as India’s largest renewable energy provider for the Commercial and Industrial (C&I) segment. The company specializes in delivering comprehensive decarbonization solutions, ranging from rooftop solar and wind-solar hybrid farms to advanced energy storage and carbon credit services. With an operational footprint spanning India, the UAE, Thailand, and Bahrain, CleanMax manages a robust portfolio of 2.54 GW in operational capacity and an additional 2.53 GW of contracted projects under execution.

The company has recently secured approximately ₹1,500 crore in a pre-IPO funding round led by global investment giants Temasek Holdings and Bain Capital. This capital raise, priced at ₹1,053 per share, serves as a precursor to its upcoming Initial Public Offering (IPO) valued at ₹5,200 crore. The IPO will consist of a fresh issue of ₹1,500 crore and an Offer for Sale (OFS) of ₹3,700 crore, aimed at strengthening the company's capital base and providing an exit for early investors while funding its next phase of global expansion.

Business Model and Operating Footprint

The company’s strategic focus on tech-heavy industries has made it a preferred partner for global technology majors, with nearly 40% of its portfolio serving clients like Google, Apple, Amazon, Meta, and Equinix. Its operational reach extends across 10 Indian states with significant concentration in Karnataka and Gujarat and international markets in the Middle East and Southeast Asia, supported by a workforce of over 460 employees.

Capex and Future Growth Drivers

The proceeds from the fresh issue of the IPO and the recent pre-IPO round are primarily earmarked for scaling operations in the capital-intensive renewable energy sector. The funds are intended for:

- Repayment of Borrowings: Approximately ₹1,125 crore is allocated to reduce outstanding debt, which stood at roughly ₹7,973 crore as of March 2025, thereby improving the company’s debt-to-equity ratio and financial flexibility.

- General Corporate Purposes: To facilitate entry into emerging green technologies, such as Battery Energy Storage Systems (BESS) and green hydrogen.

Overall, Clean Max Enviro Energy Solutions represents a significant play on the global corporate transition toward Net-Zero. By leveraging long-term contracts with blue-chip multinational corporations and securing backing from marquee investors like Temasek and Brookfield, the company is positioned as a frontrunner in the rapidly evolving renewable energy landscape.

Date: Tue 10 Feb, 2026

InSolare Energy has entered into a strategic technology transfer partnership with the U.S.-based firm Versogen Inc. to advance green hydrogen production in India. Here is a summary of the development for your feed:

Strategic Partnership: InSolare Energy & Versogen

- Technology Transfer: InSolare has licensed Versogen’s proprietary Anion Exchange Membrane (AEM) technology, including intellectual property for stack development and specialized materials.

- AEM Electrolyser Focus: The collaboration aims to develop high-performance AEM electrolysers tailored specifically for the Indian market, utilizing Versogen’s patented PiperION® technology.

- Manufacturing Plans: InSolare plans to establish a manufacturing facility in India with an initial capacity of 250–300 MW, which is designed to be scalable up to 1 GW.

- Market Goal: The partnership is focused on lowering the cost of green hydrogen to make it competitive with traditional fossil-fuel-based "grey" hydrogen, specifically targeting hard-to-abate industrial sectors.

- National Alignment: This initiative directly supports India’s National Green Hydrogen Mission and the "Make in India" program, aiming to build indigenous expertise in clean energy infrastructure.

About InSolare

InSolare Energy Limited (IEL) has emerged as one of the few companies in India to secure Production Linked Incentives (PLI) across all three categories:

- 10 MW per annum indigenous electrolyser manufacturing,

- 19,000 metric tonnes per annum of green hydrogen production, and a

- 85,000 metric tonne per annum green ammonia production under SECI's SIGHT scheme.

- With this unique achievement, InSolare has firmly positioned itself as a frontrunner in the green hydrogen and green ammonia space. The company is also planning to establish a 250–300 MW AEM electrolyser manufacturing facility in India, targeted to be operational by 2027, building on its 16+ years of expertise in renewable energy project development and EPC execution.

About Versogen

Versogen, based in the U.S., specializes in PiperION® AEM membranes, known for their high durability, efficiency, and cost-effectiveness in electrolyser applications. The company is recognized globally as a leader in advancing sustainable hydrogen solutions through its proprietary AEM technology.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.