Capgemini Technology Services Released it FY25 Results

24 September 2025

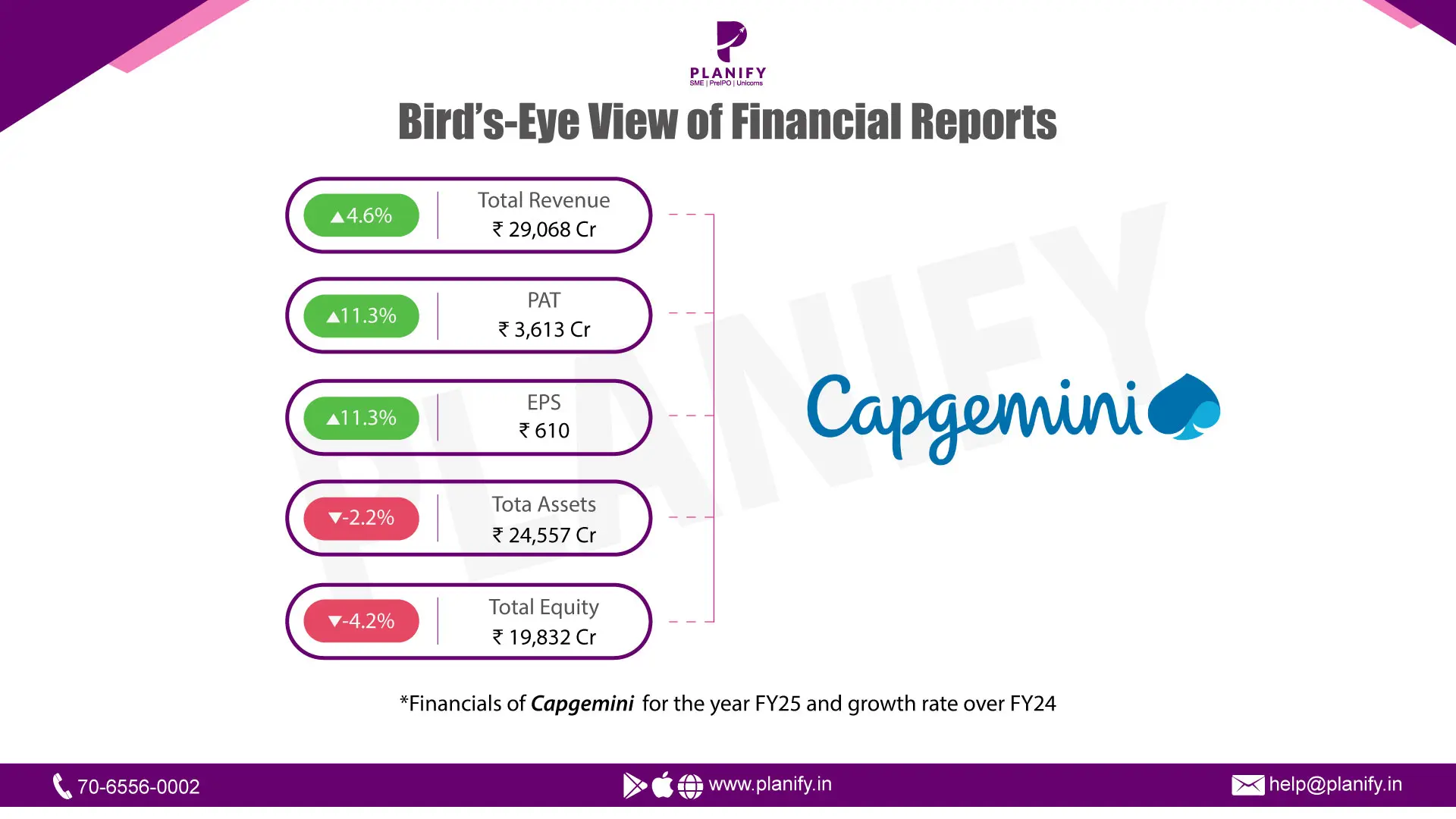

Financial Performance (FY25 vs FY24): Capgemini reported steady growth in FY25 versus FY24, with consolidated revenue rising 4.6% to ₹29,068 Cr from ₹27,786 Cr. Profitability improved as PBT increased 10.2% to ₹4,727 Cr from ₹4,291 Cr, while Net Profit (PAT) grew 11.3% to ₹3,613 Cr from ₹3,246 Cr. EPS strengthened to ₹609.6 (basic & diluted) from ₹547.6 in FY24. Margins expanded modestly as operating leverage offset higher employee costs, enabling the group to maintain robust profitability.

Operational Metrics (FY25 vs FY24): Operating expenses rose, with employee benefit costs increasing to ₹21,293 Cr from ₹20,450 Cr, and other expenses inching up to ₹2,979 Cr from ₹2,942 Cr. Finance costs were marginally higher at ₹69.5 Cr versus ₹63.2 Cr, while depreciation moderated to ₹935 Cr from ₹1,004 Cr. Net margins improved to 12.4% in FY25 from 11.7% in FY24, while EBITDA margin edged up to nearly 19.7% from 19.3%, reflecting cost discipline despite wage inflation. Balance sheet remained strong, with total assets at ₹24,556 Cr (vs ₹25,104 Cr) and equity at ₹19,832 Cr (vs ₹20,710 Cr). Cash & cash equivalents stood at ₹1,802 Cr versus ₹1,772 Cr, supported by liquidity from operations, though current investments declined due to higher dividend payouts.

Strategic Developments: Capgemini continued to strengthen its capabilities and market positioning. The Americas and Rest of World regions led revenue growth, while India showed a marginal decline. The Group pursued selective disposals and completed acquisitions in AI and digital engineering to enhance offerings. Share-based payment expenses rose to ₹291 Cr, reflecting continued workforce investment. A dividend of ₹45 per share (FV ₹10) amounting to ₹4,505 Cr was paid in FY25, alongside share buybacks to enhance shareholder returns. Sustainability remained central, with increased renewable energy sourcing and progress on carbon reduction targets, while India continued to serve as the largest global delivery hub with stable utilization.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.