CSK Released it FY25 Results

09 September 2025

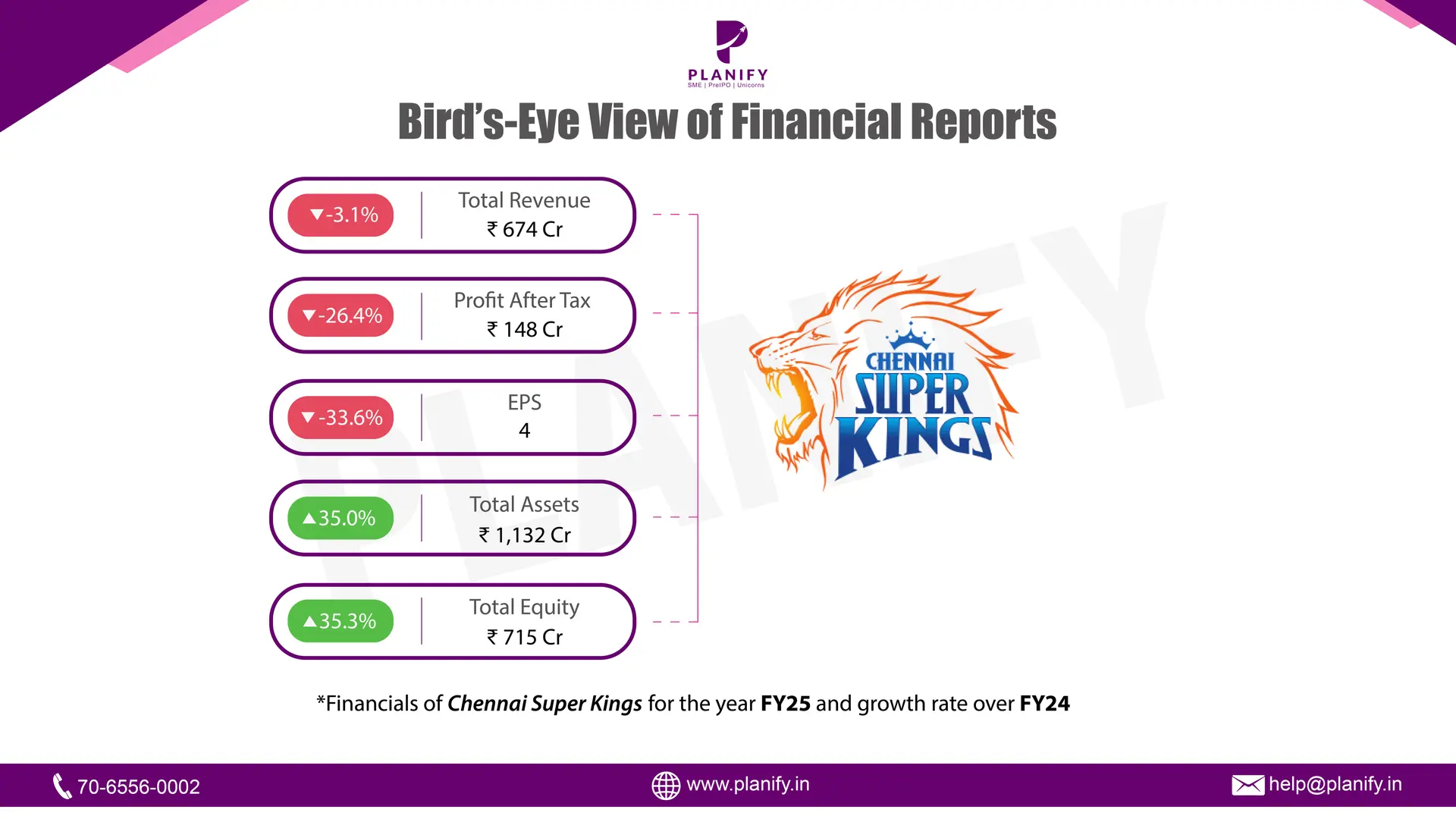

Financial Performance (FY25 vs FY24): Chennai Super Kings Cricket Limited (CSKCL) reported a softer FY25 versus FY24, mainly due to the absence of prize money that had boosted the previous year, with standalone revenue declining 4.8% to ₹644.0 Cr from ₹676.4 Cr. Profitability came under pressure as PBT contracted 20.7% to ₹243.0 Cr from ₹306.7 Cr and Net Profit (PAT) fell 21.0% to ₹180.9 Cr from ₹229.1 Cr, while EPS moderated to ₹4.8 (basic) from ₹7.0 and ₹4.8 (diluted) from ₹6.1. Despite these declines, CSKCL remained profitable, supported by cost controls and strong sponsorships. On a consolidated basis, the group posted Net Profit of ₹151.5 Cr in FY25 vs ₹201.5 Cr in FY24, reflecting similar pressures across global franchises.

Operational Metrics (FY25 vs FY24): Operating expenses rose as cost of operations increased to ₹372.0 Cr from ₹349.2 Cr, driven by franchise fees and higher player remuneration, while employee benefit costs nearly doubled to ₹12.1 Cr from ₹6.2 Cr on account of managerial remuneration and commissions. On the other hand, finance costs fell sharply to ₹1.5 Cr from ₹7.2 Cr due to deleveraging, though depreciation rose to ₹7.6 Cr from ₹2.8 Cr reflecting asset investments. Profitability softened with net margins contracting to 28.1% in FY25 from 33.9% in FY24 and operating margins moderating on higher costs. However, balance sheet strength improved as total assets expanded to ₹1,175.1 Cr from ₹900.1 Cr, supported by higher reserves, with cash & cash equivalents more than doubling to ₹336.4 Cr, significantly enhancing liquidity.

Strategic Developments: Subsidiaries continued to expand their global footprint, with Superking Ventures Pvt Ltd (India) posting revenue of ₹18.1 Cr (vs ₹5.5 Cr in FY24) and PAT of ₹5.5 Cr (vs ₹1.6 Cr loss), driven by strong growth at Super Kings Academy. Joburg Super Kings (South Africa) saw revenue rise to ₹45.3 Cr (vs ₹40.2 Cr) though losses widened to ₹32.8 Cr (vs ₹26.2 Cr) on higher player costs. Super Kings International Inc (USA) reported PAT of ₹1.8 Cr on ₹2.5 Cr revenue, and also acquired 55.5% in Texas Super Kings LLC, which generated ₹3.6 Cr revenue but incurred a ₹7.1 Cr loss in its debut season. The company recommended a dividend of ₹1 per equity share (FV ₹0.10) for FY25, while continuing to prioritize investments in sports academies, global league participation, and cricket ecosystem expansion as part of its growth strategy.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.