Blog

Planify Feed

Groww posted strong FY25 results with profitability turnaround

Link copied

Groww posted strong FY25 results with profitability turnaround

18 September 2025

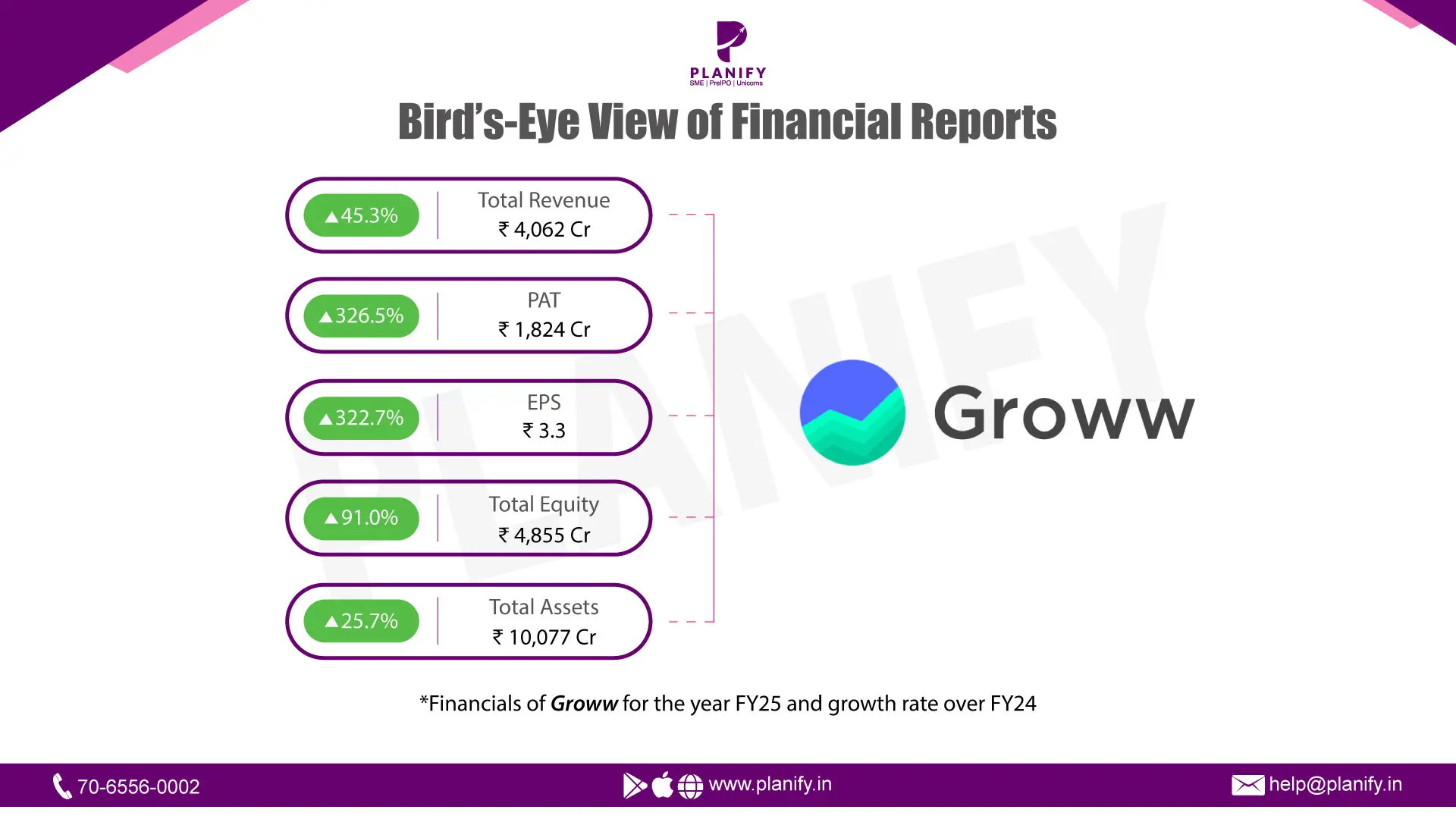

- Financial Performance (FY25 vs FY24): Groww delivered a very strong FY25 with a sharp turnaround from losses in the previous year. Total income for the year rose by 45.3%, reaching ₹4,062 Cr compared to ₹2,796 Cr in FY24, driven mainly by higher broking commissions and a sharp jump in interest income from margin funding. Profit Before Tax (PBT) stood at ₹2,464 Cr in FY25, against a loss in FY24, reflecting strong operating leverage and absence of one-off expenses. Net profit (PAT) came in at ₹1,824 Cr, reversing the ₹806 Cr loss last year.

- Operational Metrics (FY25 vs FY24): Groww’s profitability and customer metrics improved meaningfully during the year. EBITDA expanded to ₹2,306 Cr with margin improving to 59.1% from 56.4%, showing better efficiency as revenues scaled up. Net profit margin recovered to 44.9% in FY25 from a negative 28.8% in FY24. Contribution margin remained stable at 85.4%, reflecting effective cost control despite higher scale. The active customer base increased by 47.8% to 13.9 Mn, while total customer assets surged by 78.6% to ₹2.17 Lakh Cr from ₹1.21 Lakh Cr in FY24. Strong growth in revenues per employee and consistent operating leverage supported higher earnings, even as technology and transaction costs rose with higher trading volumes.

- Strategic Developments: FY25 proved to be a landmark year for Groww, with record profitability, strong user growth, and rising customer assets reflecting the company’s ability to scale efficiently. Operating leverage supported stable margins, even as investments in technology and infrastructure continued. To build on this momentum, Groww has filed for an IPO in 2025. The proposed listing aims to strengthen its capital base, widen product offerings, and accelerate investments in digital platforms. It will also provide an exit route for existing investors and enhance visibility in India’s growing wealth-tech space. Looking ahead, the company plans to deepen customer engagement, expand in underserved markets, and drive adoption of newer products such as margin financing and lending. While Groww has emerged as a profitable fintech leader with growing market share, maintaining margin discipline in an increasingly competitive broking industry will remain a key focus area.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.