NCL Buildtek Ltd posts weaker PAT despite higher revenue

22 December 2025

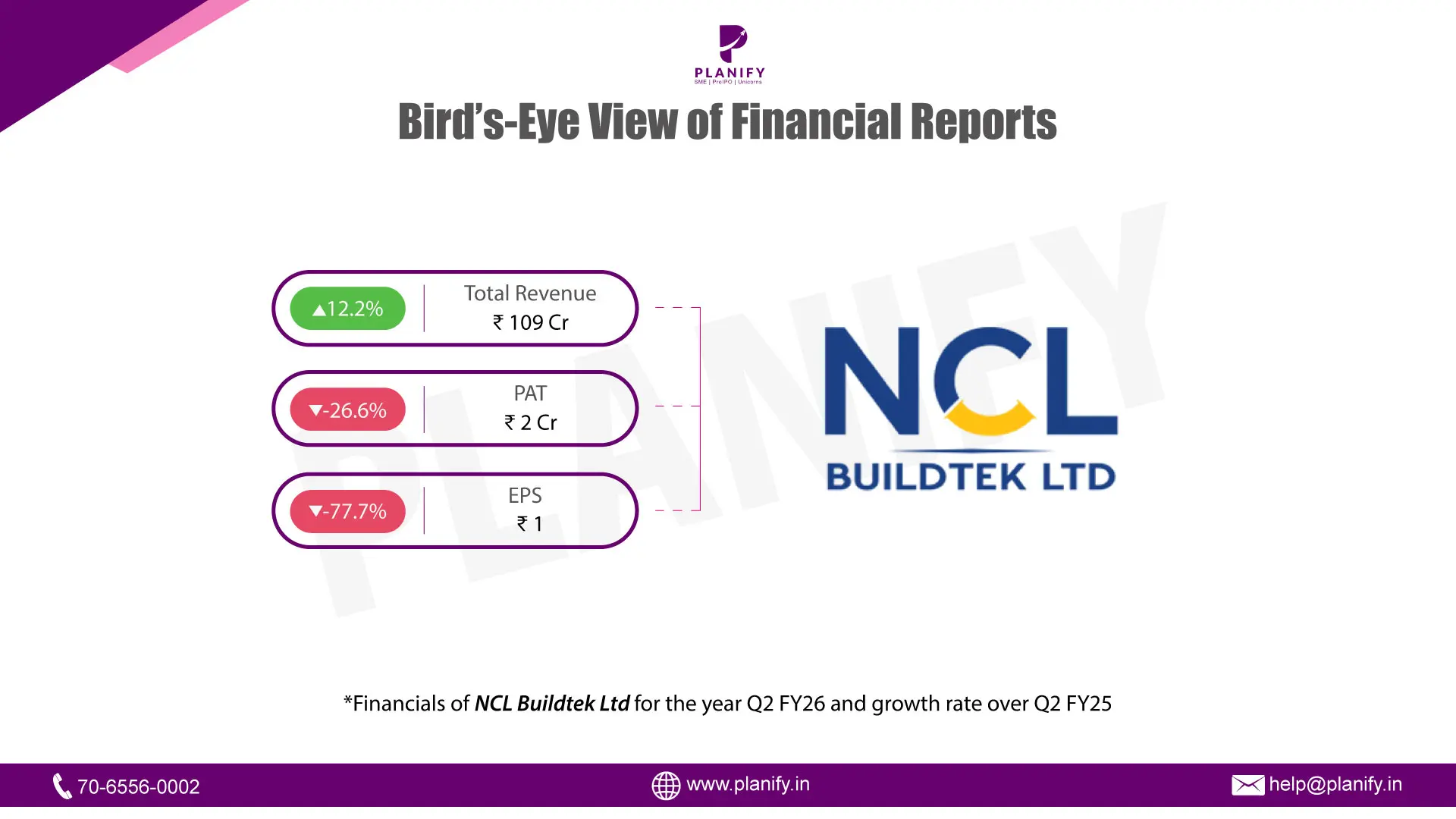

Financial Performance (Q2 FY26 vs Q2 FY25): NCL Buildtek Ltd reported a mixed set of numbers for Q2 FY26. Revenue from Operations (Consolidated) increased by 12.2% year-on-year (YoY) to ₹10,852.52 lakh, compared to ₹9,673.59 lakh in Q2 FY25. However, despite the growth in topline, Profit After Tax (PAT) declined by 26.6% YoY to ₹234.64 lakh, down from ₹319.51 lakh in the same quarter last year. This drop occurred even though Profit Before Tax (PBT) (after exceptional items) rose to ₹333.14 lakh from ₹194.81 lakh in Q2 FY25. The decline in PAT was primarily driven by a significant tax expense of ₹98.50 lakh in the current quarter, compared to a tax credit adjustment in the previous year. Consequently, Earnings Per Share (EPS) (including exceptional items) fell to ₹1.22 from ₹5.47 in the corresponding period last year.

Operational Metrics (Q2 FY26 vs Q2 FY25): Operational performance varied significantly across business segments. The Coatings segment posted strong growth, with revenue rising to ₹2,560.97 lakh from ₹2,188.84 lakh last year, and segment profit nearly doubling to ₹341.56 lakh. The Windoors segment remained the largest contributor, with revenue increasing to ₹5,867.59 lakh from ₹4,863.83 lakh. However, margins remained tight; the consolidated Operating Margin stood at 5%, while the Net Profit Margin was recorded at 2% for the quarter. The Interest Coverage Ratio was reported at 1.56 times, reflecting the impact of finance costs, while the Debtors Turnover Ratio stood at 1.88 times.

Strategic Developments: During the quarter, the company recorded an exceptional item gain of ₹79.99 lakh, which supported the profit before tax figures. While the Windoors and Coatings divisions showed resilience and growth, the Walls segment faced headwinds, reporting a segment loss of ₹84.08 lakh compared to a minor loss of ₹0.98 lakh in Q2 FY25. The company’s consolidated Net Worth stood at ₹23,060.09 lakh as of September 30, 2025, maintaining a stable capital base despite the pressure on bottom-line profitability. The financial results were reviewed by the Audit Committee and approved by the Board of Directors on November 13, 2025.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.