Blog

Planify Feed

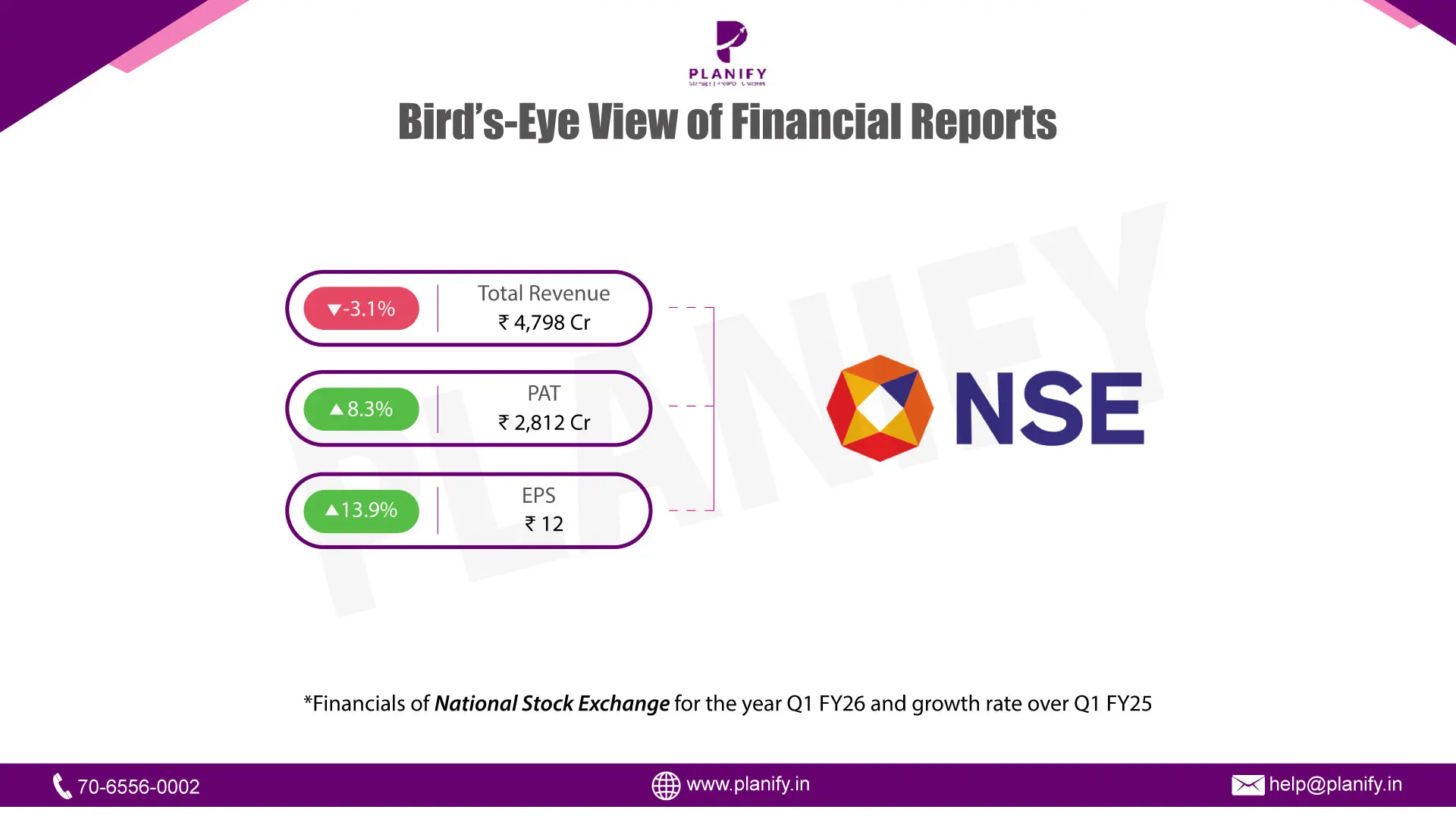

NSE announced its Q1 FY26 results

Link copied

NSE announced its Q1 FY26 results

05 August 2025

- Financial Highlights: In Q1FY26, the National Stock Exchange of India (NSE) reported a consolidated total income of ₹4,798 crore, marking a 9% QoQ increase, driven primarily by a 7% sequential growth in transaction charges to ₹3,150 crore due to increased trading volumes in both the cash and derivatives markets. Notably, total expenditure decreased by 6% QoQ to ₹1,053 crore, reflecting operational efficiency gains. This led to a 12% QoQ rise in consolidated operating EBITDA to ₹3,130 crore and a 10% rise in net profit to ₹2,924 crore, with EPS improving from ₹10.71 to ₹11.81. Excluding one-offs, normalized PBT rose 12% QoQ to ₹3,683 crore, underscoring strong underlying business momentum.

- Operation Highlights: On a standalone basis, while the reported total income of ₹4,243 crore declined from ₹5,860 crore in Q4FY25 due to one-time dividend income from prior subsidiary divestments, the underlying business showed resilience with a 9% QoQ increase when adjusted for these one-offs. Revenue from operations stood at ₹3,608 crore (up 6% QoQ), supported by higher average daily traded volumes (ADTVs): the cash market surged 14% to ₹1.08 lakh crore, equity futures rose 5% to ₹1.68 lakh crore, and equity options grew 9% to ₹55,514 crore in premium value. Standalone operating EBITDA also rose 11% QoQ to ₹2,714 crore, and normalized PBT increased 13% QoQ to ₹3,141 crore, demonstrating robust core profitability.

- Future Outlook: Looking forward, NSE's continued dominance in trading volumes and market infrastructure positions it strongly amidst a growing equity culture and increasing retail participation in India. Its global leadership in derivatives volumes (ranked #1 globally in 2024 by FIA) and #2 in equity trades (WFE, 2024) reinforces its operational scale. Strategic focus on technology innovation, regulatory compliance, and diversified revenue streams across exchange services, indices, market data, and technology solutions is expected to sustain growth. Its substantial ₹14,331 crore contribution to the exchequer in Q1FY26 reflects its central role in India's financial ecosystem, supporting its long-term outlook.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.