PPFAS posts a Robust growth in Q2 FY26

23 December 2025

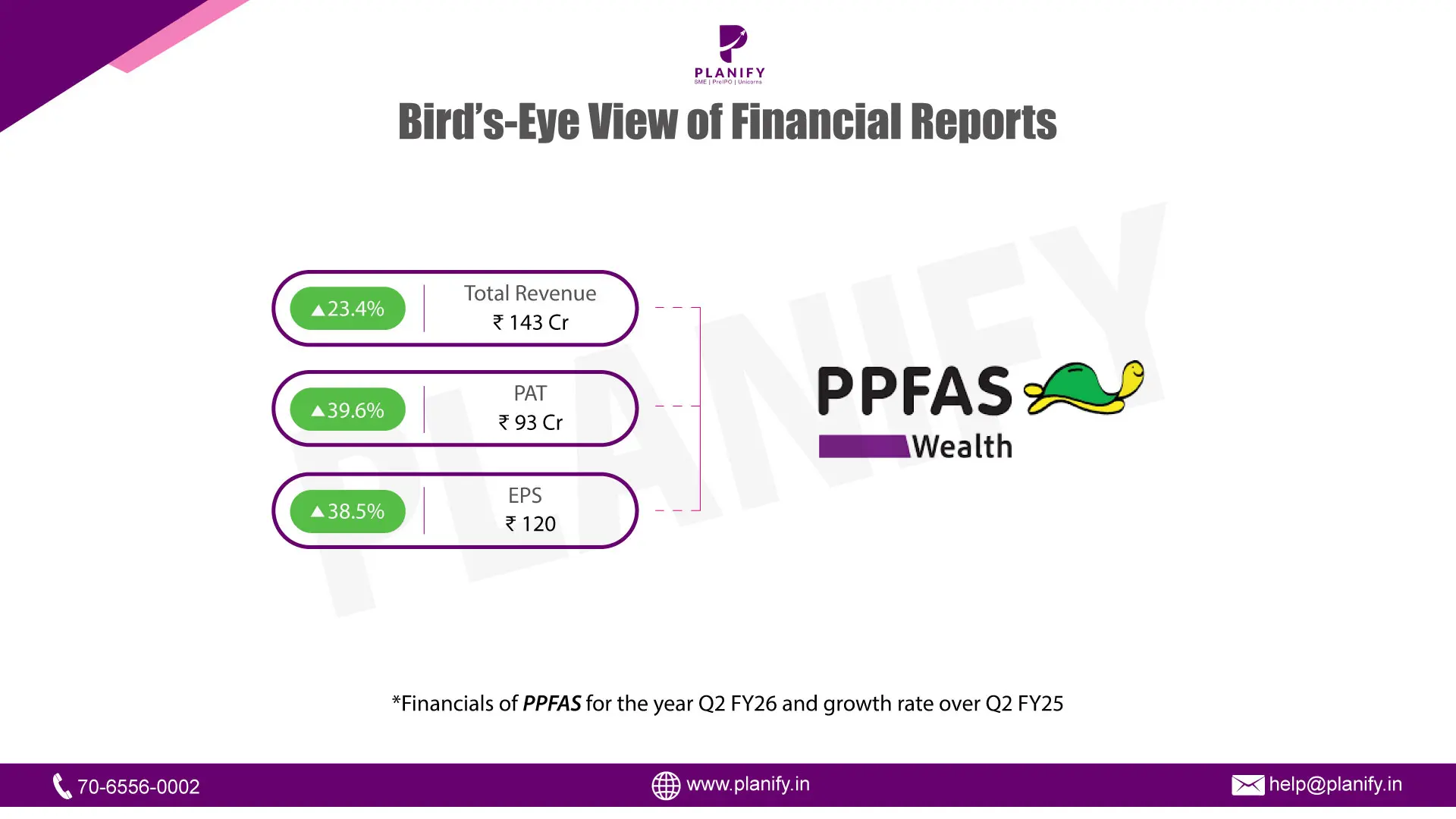

Financial Performance (Q2 FY26 vs Q2 FY25): PPFAS reported a robust financial performance in Q2 FY26, with total revenue increasing by 23.4% year-on-year (YoY) to ₹143 crore, compared to ₹116 crore in Q2 FY25. The growth was primarily driven by an increase in fees and commission income from its asset management business. Profit Before Tax (PBT) rose significantly by 37.2% YoY to ₹123.8 crore from ₹90.2 crore in the same quarter last year. Profit After Tax (PAT) grew by 39.6% YoY to ₹92.7 crore, compared to ₹66.5 crore in Q2 FY25. Earnings Per Share (EPS) also saw a substantial increase, rising to ₹120.5, from ₹86.7 last year.

Operational Metrics (Q2 FY26 vs Q2 FY25):Operational performance demonstrated strong efficiency and margin expansion during the quarter. The net profit margin improved to 65.3% in Q2 FY26 from 57.3% in Q2 FY25, reflecting better cost leverage. Total expenses for the quarter stood at ₹19.2 crore, managed effectively against the rising revenue base. The company remains debt-free with only lease liabilities on the books, maintaining a robust balance sheet. The company’s consolidated net worth surged to ₹828.5 crore, up 55.4% YoY from ₹533.2 crore in September 2024, highlighting significant internal accruals and financial strength.

Strategic Developments: During the period, the company paid a final dividend of ₹11.54 crore for the previous financial year, underscoring its commitment to shareholder returns. A key accounting policy change was implemented, shifting the depreciation method for Property, Plant, and Equipment from Written Down Value (WDV) to the Straight Line Method (SLM) to align with group policies. The company continues to distinguish its "Core" operating performance by excluding unrealized mark-to-market gains on investments, which stood at ₹30 crore for the half-year, ensuring a transparent view of business health.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.