Robust financial performance of OYO in Q1 FY26

09 January 2026

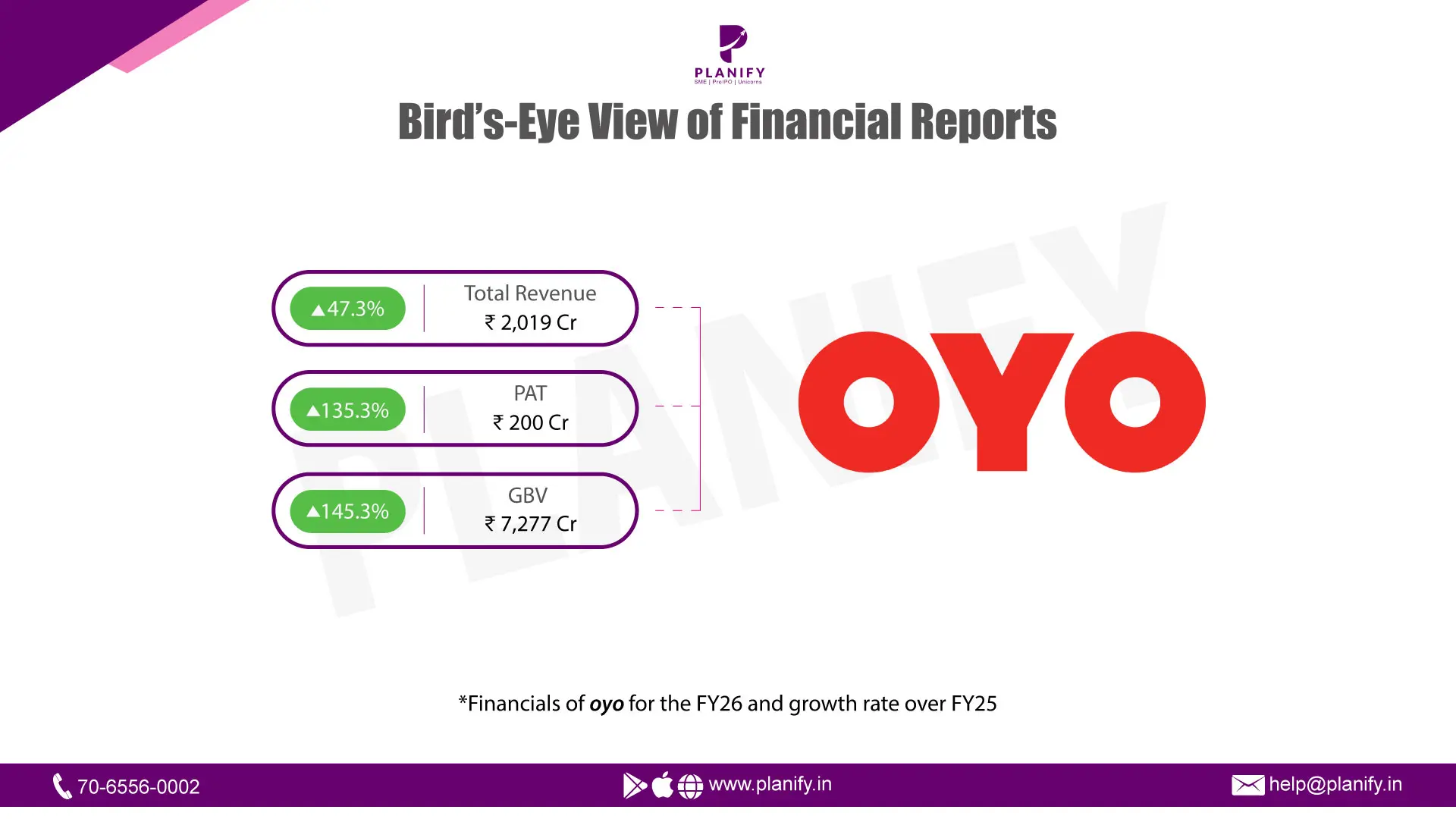

Financial Performance (Q1 FY26 vs Q1 FY25): OYO reported a robust financial performance in Q1 FY26, with Revenue increasing significantly by 47.26% year-on-year (YoY) to ₹2,019 crore, compared to ₹1,371 crore in Q1 FY25. This strong topline growth reflects sustained demand momentum across its core markets. Profit After Tax (PAT) more than doubled, surging by 135.29% YoY to ₹200 crore, up from ₹85 crore in the corresponding quarter last year. The profitability surge was further highlighted by Adjusted EBITDA, which grew 3.3x YoY to ₹550 crore, supported by enhanced operational efficiencies and higher operating leverage.

Operational Metrics (Q1 FY26 vs Q1 FY25): Gross Booking Value (GBV) expanded by 145.35% YoY to reach ₹7,277 crore, underscoring significant market share gains. The Hotels segment led the momentum with a 221% YoY increase in GBV (₹5,939 crore), while the Homes segment grew by 16% YoY (₹1,288 crore). The global supply footprint for Hotels grew by 29% (to 22K), and Homes increased by 44% (to 124K). Storefront Expansion: OYO rapidly scaled its mid-premium and premium company-serviced portfolio in India, with storefronts expanding 5x YoY to reach 1.1K. Managed Workspaces: The Innov8 segment reported revenue of ₹37 crore (up 55% YoY) and an EBITDA surge of 189%.

Strategic Developments & Outlook: OYO’s net worth and operational efficiency continue to provide strong capital support, with a strategic shift toward Company-Serviced properties, which now contribute 51% of GBV, up from just 9% a year ago. The company is maintaining a disciplined cost structure, with operating costs projected to fall from 12% to 8% of GBV by the end of FY26. A key strategic milestone is the IPO timeline, with the company planning to launch its public offering in the second half of 2026. Near-term focus remains on strengthening the balance sheet, maintaining positive cash flows, and leveraging technology to lift RevPAR and guest retention.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.