Blog

Planify Feed

Studds Accessories released its financials for FY25

Link copied

Studds Accessories released its financials for FY25

18 August 2025

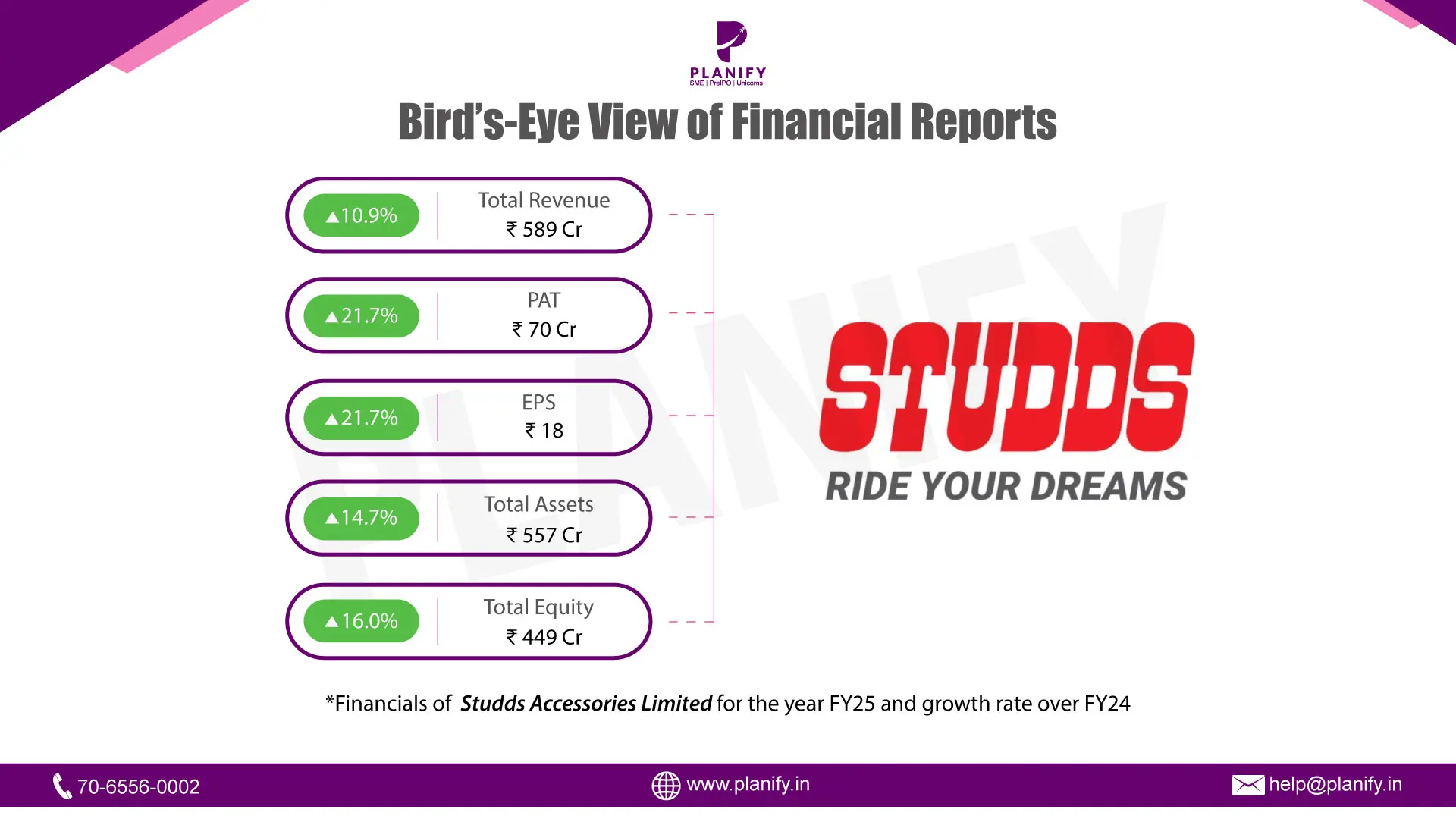

- Financial Performance: Studds Accessories Limited delivered a strong FY25 performance, consolidating its position as the world’s largest two-wheeler helmet manufacturer by volume. Revenue from operations grew ~11% YoY to ₹589 crs, driven by robust demand across domestic and international markets. Exports were a key growth lever, rising ~82% to ₹97 crs. EBITDA expanded to ₹118 crs with margins above 20%, aided by disciplined cost management, stronger procurement practices, and efficiency gains. Profit after tax improved to ₹70 crs, while net worth rose to ₹450 crs, underscoring the company’s financial resilience.

- Operational Developments: Operationally, Studds produced over 7.5 million helmets and boxes, leveraging four advanced facilities in Faridabad and a vertically integrated model that ensures quality, safety, and cost competitiveness. The company introduced smart helmets with Bluetooth connectivity and advanced safety features, alongside its innovative “Thunder Detect” compliance helmet for delivery fleets, showcasing its R&D leadership. Strategic milestones included the acquisition of Bikerz Us Inc. in the US to strengthen its Americas presence and ongoing capacity expansion with a fifth facility scheduled to be operational by FY26. Complementing this, investments in marketing, digital transformation (ERP, WMS, B2B/B2C portals), and sustainability initiatives further enhanced global competitiveness.

- Future Outlook: Looking ahead, Studds is well-positioned to benefit from regulatory mandates for BIS-certified helmets, rising safety awareness, and growing premiumization trends. The Indian two-wheeler helmet market is projected to grow at a 6.1% CAGR to 3.5 crs units by CY29, while global expansion opportunities under the “China+1” strategy remain strong. The company aims to scale production capacity, deepen penetration in the Americas and Europe, and pioneer eco-friendly, tech-enabled products. While risks such as inflationary pressures, raw material price volatility, regulatory costs, and competition from unorganized players remain, Studds’ strong brand equity, innovation pipeline, and capital-efficient model provide a robust foundation for sustained growth.

Stay Connected, Stay Informed –

Join Our

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.