Why Urban Tots Share Could Be the Next Big Growth Story in India’s Toy Industry

Oct 18, 2025

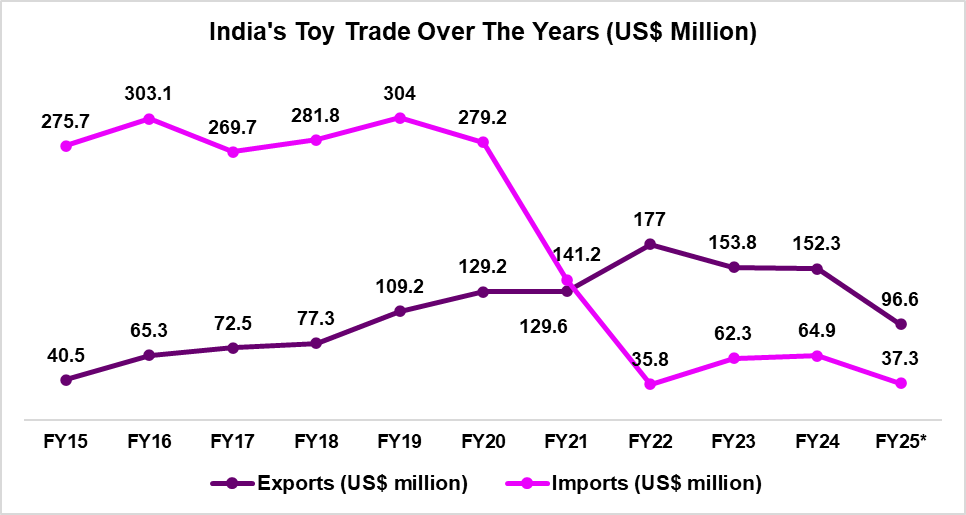

Not long ago, India’s toy shelves were dominated by imports — cheap, low-quality, and largely unregulated. But the tide has turned.

With the government tightening quality standards under the Toys (Quality Control) Amendment Order, 2024, only certified, compliant, and credible manufacturers can now compete. The result?

A level playing field — and a once-in-a-decade opportunity for Indian toy makers who can deliver quality at scale.

That’s where Deepak Houseware & Toys Ltd (DH&T) steps in. From humble beginnings as a plastic goods manufacturer, DH&T has emerged as a high-growth player in the organised Indian toy market, riding the wave of regulatory reform and a consumer shift toward safe, certified, and proudly Indian toys. DH&T, with its proven growth, strong balance sheet, and first-mover advantage, is positioned to become a key national brand in a market that’s finally valuing Made in India.

Why This Matters to Investors

India’s toy industry is at an inflexion point. Regulations have raised entry barriers, consumers are trading up, and organised players are consolidating share.

Government Initiatives and Policy Support

The Indian government has implemented a series of strategic measures to strengthen the domestic toy industry, reduce dependence on imports, and position India as a global manufacturing hub.

Make in India & Atmanirbhar Bharat: These flagship programs actively promote local manufacturing, encouraging Indian companies to scale capacity, adopt advanced technologies, and compete globally.

Higher Import Duties: Customs duties on toys have been increased from 20% to 70%, discouraging low-cost imports and creating a more level playing field for domestic producers.

Quality Control Orders (QCOs): Mandatory BIS certification and strict safety norms have enhanced product quality, ensuring consumer trust and aligning Indian products with global standards.

Production Linked Incentive (PLI) Scheme: Targeted incentives support companies investing in innovative, export-focused, and high-quality toy manufacturing, accelerating capacity expansion and competitiveness.

Together, these initiatives are reshaping India’s toy industry, fostering self-reliance, and attracting both domestic and international investment into the sector.

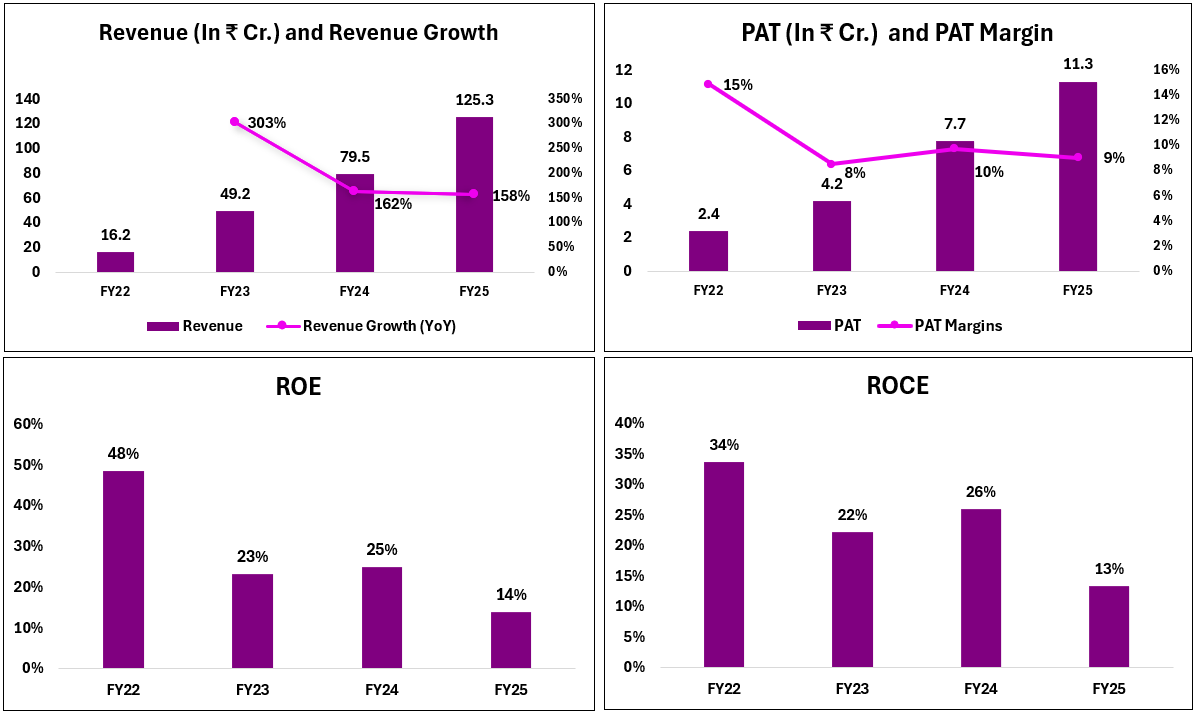

Financial Highlights of Urban Tots -:

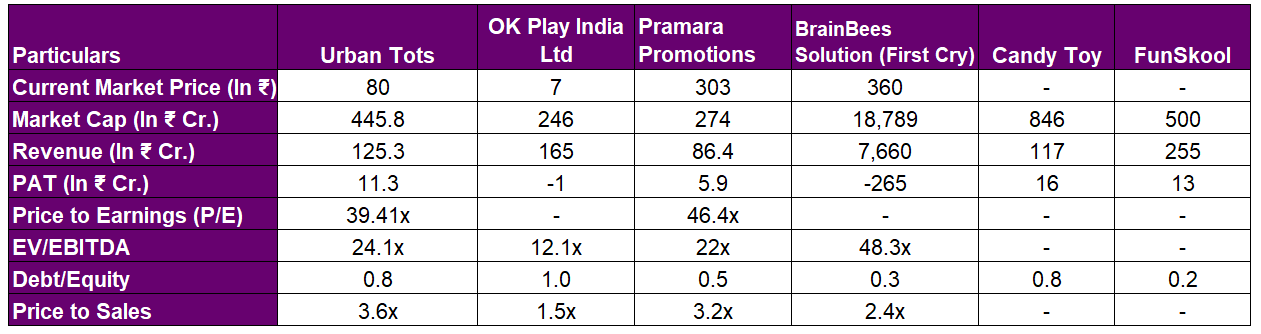

Competitive Landscape (FY25):

Company | Business focus/toy exposure | Strengths | Key weakness/investor note |

DH&T | Manufacturing of electronic and plastic toys (Urban Tots brand), small-format electronics/role-play, ramping capacity, BIS/regulatory focus. | Strong FY25 revenue/PAT growth (~58% / ~59% YoY); expanding PPE & capacity; positioned to win BIS-driven local sourcing. | Relatively small scale vs national players; working-capital stretch (receivables ↑); |

OK Play India Ltd | Plastic moulded toys, playground equipment, school furniture, and some auto components. | Longstanding brand/manufacturer with a broad product mix; listed equity/liquidity. | Revenues are volatile; margins are weak; working capital and promoter/pledge issues flagged by screens. |

MPL / MPL Plastics Ltd | Injection molding/plastics; supplies components / some toy segments. | Manufacturing capability in plastics/contract work for brands. | Low scale; weak profitability; micro-cap / limited liquidity — not a direct scale competitor for organised retail orders. |

Hanung Toys & Textiles Ltd | Soft/plush toys, licensed characters in the past (exports focus historically) | Legacy in soft toys/export relationships. | Operational distress, very low market cap, irregular trading, and long receivable cycles were reported. |

Brainbees Solutions Ltd | Omni-channel baby/kids retail (FirstCry) — toys are a major category (retail/marketplace). | Biggest distribution reach in kids retail; control over shelf space & private labels; scale & logistics. | Not a manufacturer — price negotiating power with makers; has faced regulatory/BIS scrutiny on product compliance (recent seizure event reported). |

Looking Ahead

Over the next three years, DH&T plans to:

Expand manufacturing capacity with higher BIS-compliant product lines

Launch STEM & tech-based toy categories to capture premium growth

Deepen distribution across major e-commerce and retail networks

Optimise working capital to fund organic expansion without excessive debt

Bottom line (balanced view)

DH&T combines clear regulatory tailwinds, recent demonstrable execution (58% revenue growth, 59% PAT growth in FY25), and capital/capacity investments required to win large organised retail contracts. Those three — if sustained with disciplined working-capital management and compliance — make DH&T a credible candidate to be a high-growth, mid-market Indian toy manufacturer.

Stay Connected, Stay Informed –

Don’t miss out on exclusive updates, market trends, and real-time investment opportunities. Be the first to know about the latest unlisted stocks, IPO announcements, and curated Fact Sheets, delivered straight to your WhatsApp.